Lucrative fintech startup ideas include digital/P2P payments apps, money lending apps, trading and investment apps, DeFi solutions, RegTech Apps, Insuretech, neobanking, personal finance apps, and digital/mobile banking apps. Fintech solutions offered through a user-friendly experience of a mobile app are currently in high demand among GenZ and Millennials (the majority of target users for digital finance solutions).

These applications ensure a revenue-driven outcome while being cost-effective to build, the two most important factors for startups. However, there are also some other potentially beneficial ideas that a startup can look into and choose for a new business.

In this article, we will take a closer look at fintech startup ideas to understand and determine their advantages and feasibility for startups.

8 Promising Fintech Business Ideas for Startups

Every one of the fintech app ideas mentioned below requires a business strategy, development plan, well-managed execution, and a decent budget to support the operation until the business succeeds.

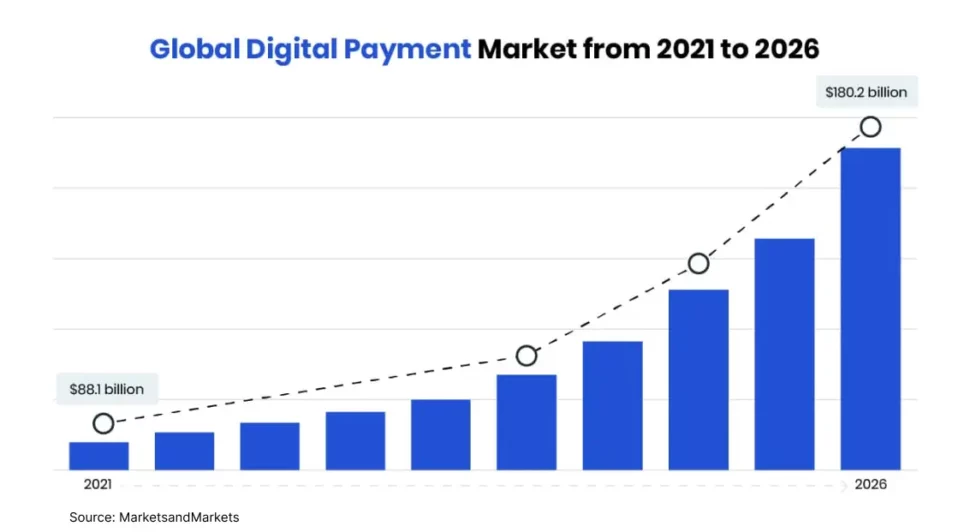

Digital Payment Apps

Digital mobile payment apps (P2P) enable users to send money online to any person or organization with a bank account in a few seconds. Some popular payment apps are PayPal, Venmo, and Apple Pay. These apps are highly popular as they make online payment a highly convenient task with a few clicks.

P2P Payment apps remove the need for withdrawing money, a complex net-banking payment process, or keeping paper-based money safe from damages like water or fire. These fintech app features simplify the payment process for a global user base.

Source: MarketsandMarkets

Building a payment app gives your business access to a large target audience looking for a user-friendly platform to make quick payments. However, the market is highly competitive with giants like PayPal and Apple Pay meeting the needs of the majority of target users.

Offering a simple and attractive interface, customer-centric navigability, and convenient ease of use are three ways to attract target customers to your P2P payment app. Despite the competition, this is one of the best fintech startup ideas that can lead to faster acquisition, customer engagement, and business revenue.

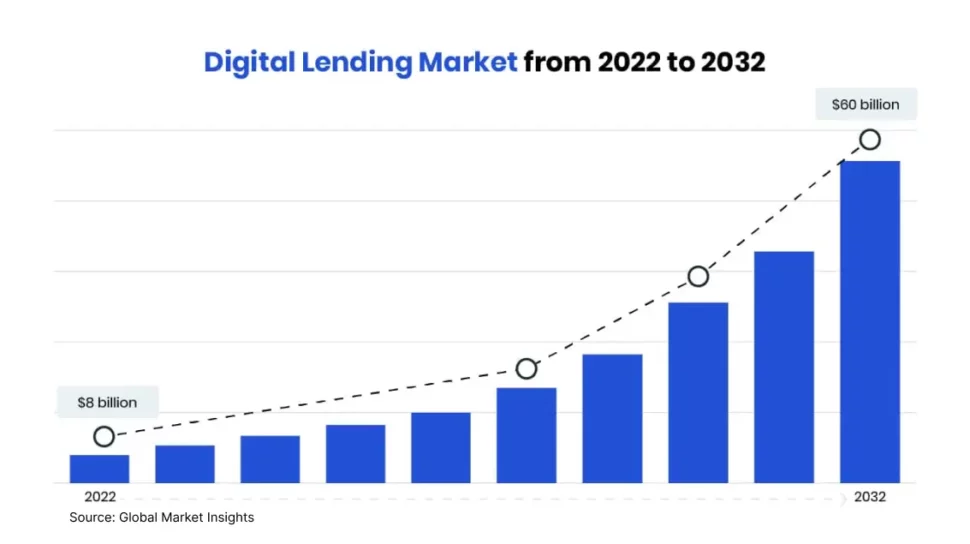

Money Lending (Loan) Apps

Money lending apps help users apply for a small or big loan online, get their application reviewed, and have the loan money credited to their account within a matter of hours. The process of loan applications is easy, fast, and completely secure. Most money-lending apps use AI-based technology for faster application evaluations to determine approval or rejection. The top mobile loan apps are MoneyLion, Earnin, and Brigit.

Source: Global Market Insights

Unlike the digital payment market, having a lot of competition does not complicate the success of your money-lending app. It is because every money lending app has a different application review system. And a loan is a product/service that is always in high demand.

It means that some or the majority of target users will consider and use your money-lending app if it has a simple/automated application process, faster reviews, and multiple offers. Building a loan app requires fintech domain experts that know how to comply with all the necessary or legal standards (For example, PCI DSS and GDPR) required for a fintech app.

As far as fintech app ideas are concerned, a money lending app is the most revenue-driven idea you can choose.

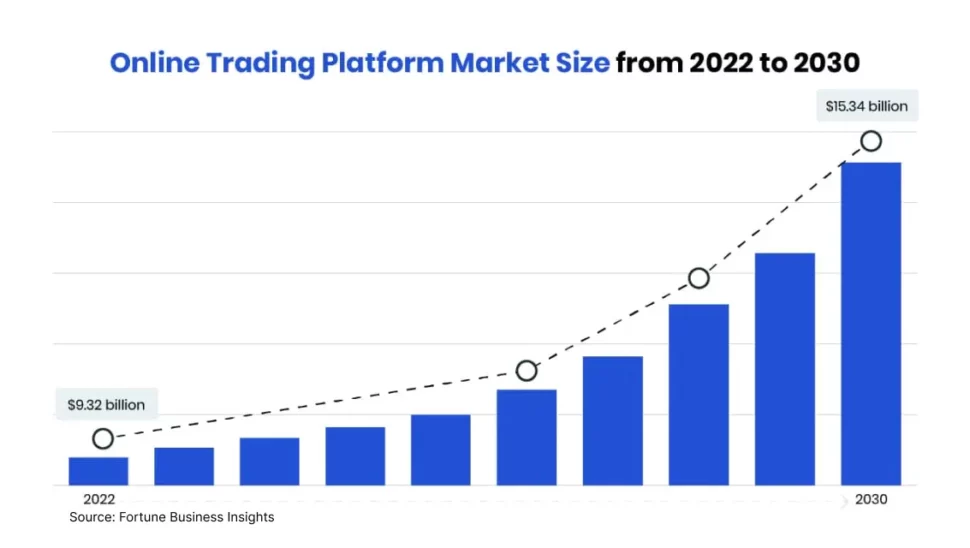

Trading and Investment Apps

Trading and investment apps are platforms where users can buy, sell, and invest in stocks/assets that promise lucrative returns. These apps offer a user-friendly mobile platform for experienced and new traders, stock breakers, and trading agencies. Many trading apps also have AI-based solutions that help users make informed decisions when investing in stocks. E-Trade, Robinhood, and TD Ameritrade are the top trading apps in the market right now.

Source: Fortune Business Insights

Building a trading app is one of the promising finance app ideas to consider as it has the potential for rapid growth. The major issue in online trading is the complex platforms that create unnecessary confusion for traders, leading to a bad experience and poor decisions.

Solving this problem with a simple and user-centric interface can help you attract a large number of users. To do this, you need highly skilled UI/UX designers and trading industry experts.

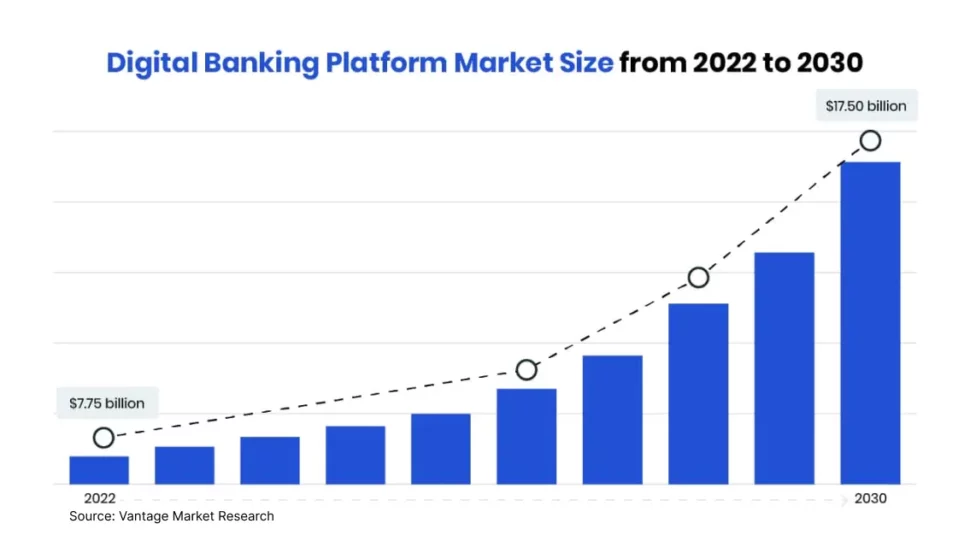

Digital Banking App

A digital banking app enables users to conduct their online banking activities like payments, creating a new account, KYC, and applying for a credit card or personal loan. Most of the banks now have their own mobile app. The top mobile banking apps are Bank of America, Capital One, and Varo. However, the industry always has room for more banking apps that simplify the whole net banking process.

Source: Vantage Market Research

A global survey of fintech app users indicates that customers want an online banking app that offers a one-stop solution for digital/P2P payments, bank account management, credit card applications and management, loans, trading and investments, e-cheques, and money deposits.

On top of that, data encryptions, multi-factor authentication, and compliance with fintech standards are also a necessity when building a banking app. But with the right fintech app development services, you can build a user-driven online banking app that meets or exceeds target user expectations.

An online banking app is a great business idea for banks and other financial institutions looking to create a cost-effective and lucrative fintech solution.

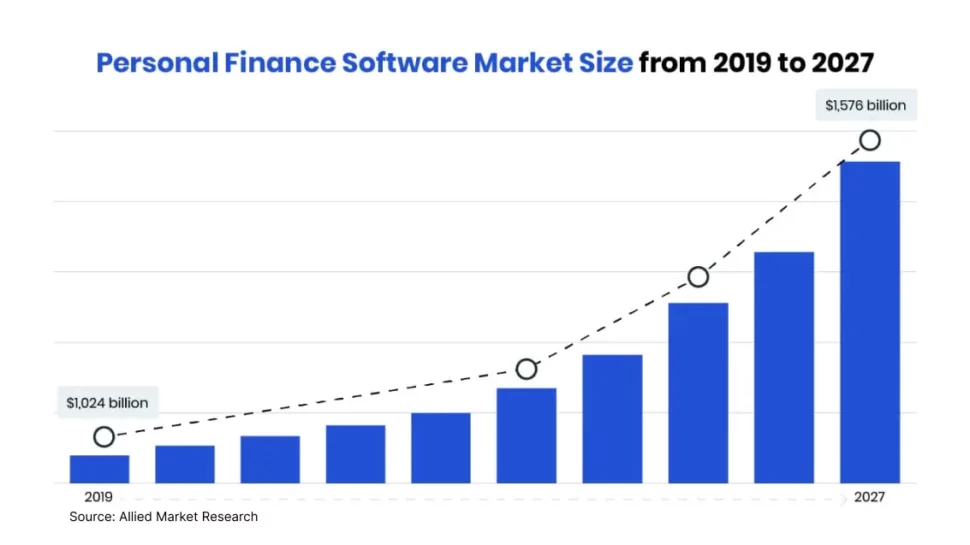

Personal Finance Apps

Personal finance apps help users conduct budget planning, track money spending, bill payments, investment tracking, insurance management, saving and retirement planning, and mortgage planning. Like digital payment and money lending, personal finance apps also have a large user base that is always looking for an easy-to-use and secure platform to conduct these financial activities. Mint, Prism, YNAB, and Spendee are currently the top fintech apps in the personal finance market.

Source: Allied Market Research

As a fintech enterprise or startup, choosing to build a personal finance app is a highly lucrative decision. If you offer a user-friendly experience, you can quickly expect a large user base, faster customer acquisition, engagement and retention, effective revenue stream, and business growth.

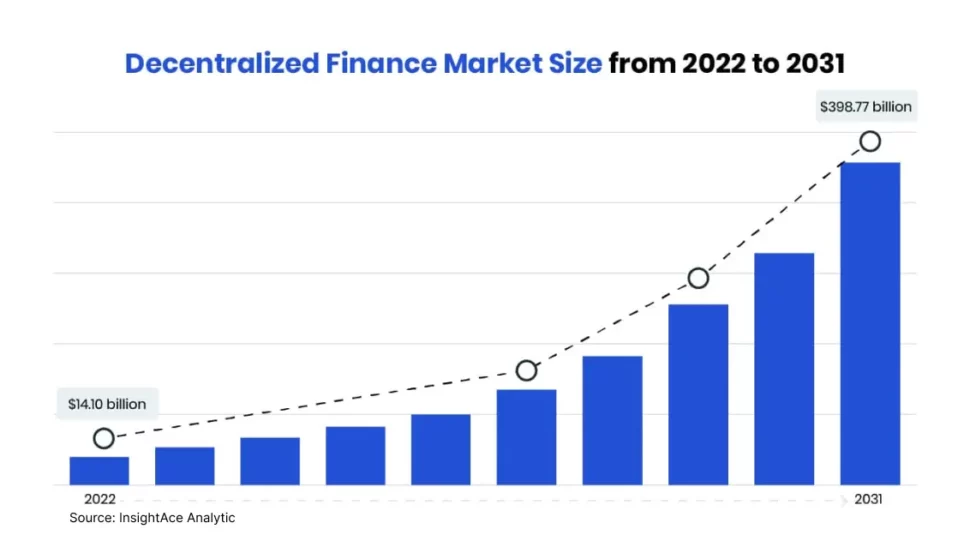

DeFi

DeFi (decentralized finance) is a blockchain model involving a range of financial applications in cryptocurrency and stablecoins (Ethereum). It helps simplify cryptocurrency transactions, management, and other financial solutions. As it is decentralized, DeFI provides open access to secure monetary platforms by preventing the need/involvement of traditional banks and financial institutions. Compound, Aave, and Uniswap are the top DeFi apps in the market.

Source: InsightAce Analytic

Making P2P payments, money lending, and asset management are some of the things users can do with a DeFI platform. It offers secure transactions, financial privacy, and faster payments through a wallet.

Personal data and financial security is becoming more and more important due to it becoming less and less reliable at the same time. At such a time, building a secure DeFI platform/wallet can help you attract a large user base looking for a secure fintech platform.

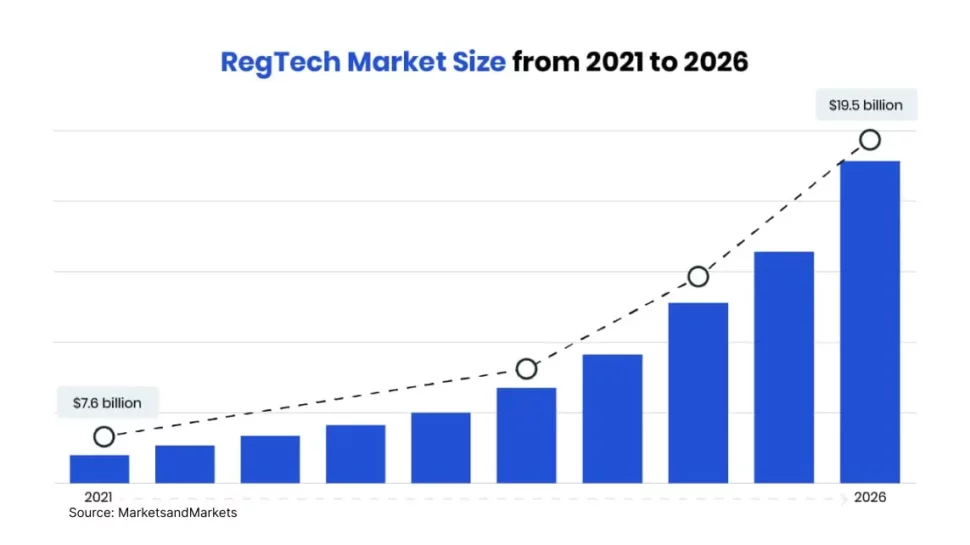

RegTech Apps

RegTech apps help customers and businesses implement the use of advanced technology to facilitate regulatory compliance in their financial institutions. They help with risk management, regulatory monitoring, reporting, compliance, identity management, transaction monitoring, and automating repetitive tasks. A reg tech app can also automate compliance data management, fraud prevention, and employee monitoring.

Source: MarketsandMarkets

Companies are always ready to invest in RegTech for meeting the regulatory compliance requirements of their financial institutions. Building a customized or one-stop regtech app can give you a competitive edge and help succeed faster. These apps are high in demand in the financial industry and have the potential for rapidly growing revenue if you build a user-driven application.

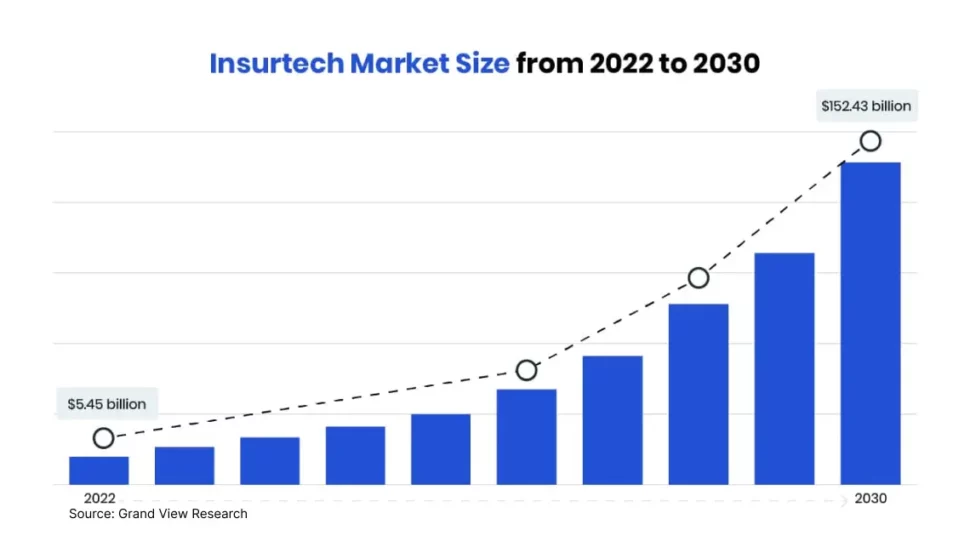

Insurtech Applications

Insurtech is the use of advanced technology to increase the operational efficiency of insurance industry solutions. Customers can use Insurtech applications for tasks like insurance business administrations and distributions, wealth management, risk evaluations, claims processing, and contract processing. The top active and successful Insurtech apps are Robinhood, Hippo, and Lemonade.

Source: Grand View Research

Insurtech applications can significantly increase sales while improving customer service and satisfaction for insurance companies. Additionally, these are one of the few fintech apps that are easy, faster, and cost-effective to build, making them ideal software startup ideas for new businesses.

Final Note

Building a digital fintech business will most certainly need the assistance of an experienced app development partner. Your primary job is to choose lucrative fintech startup ideas and set your goals. Looking into advanced finance tech technology like artificial intelligence, IoT, and blockchain will also prove beneficial when building a startup fintech business.

Once you decide the type of fintech business you want to build, you can start looking into different fintech developers, their portfolios, expertise, skills, location, and rates of their services. You can evaluate all these factors to choose a developer partner most suitable for your requirements and feasible for your fintech project budget.

Frequently Asked Questions

To start a fintech startup, you must choose a business idea like a payment or money lending app, determine business goals, plan the budget, and hire a reliable development partner.

Artificial Intelligence, DeFi (Decentralised Finance), Blockchain, RegTech, and User-friendly Experience are currently the top 5 trends in the fintech industry.

They make money by charging a small fee on every transaction made or service availed (claims processing) through the app. Some also make money with paid advertising and featured listings for financial institutions.

You can validate a fintech app idea by defining a problem that your app will solve, identifying the target audience, researching the market demand for your app, understanding the customer journey, and testing the idea.

The minimum capital required to start a fintech business can range from $45,000 to $120,000. But the exact cost depends on your business idea, goals, products/services offered, and development partners.

.png)

.png)

.png)

Great post! For unparalleled market insights and research resources tailored specifically to the market research industry. Looking forward to more engaging content from you!