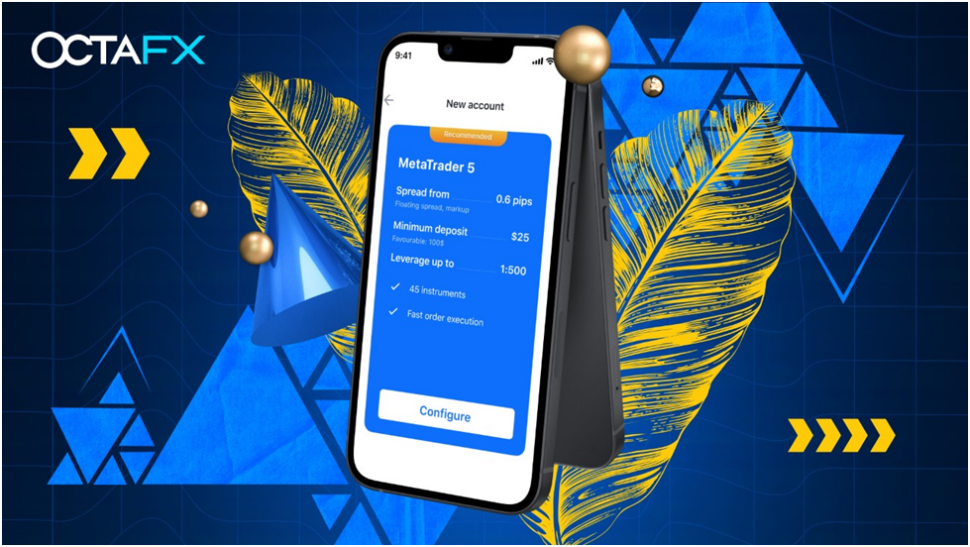

Apps like OctaFX have democratized forex trading, making it accessible to anyone with a smartphone and a thirst for financial adventure. But what if you could build your powerhouse (Web App Development) trading app that surpasses even the mighty OctaFX in features and finesse?

Buckle up, aspiring entrepreneur, because this blog is your roadmap to forex app glory!

Forex is the biggest market in the world, and lots of folks want to use it to earn some extra cash.

By creating a simple and user-friendly forex trading app, you can provide a trustworthy tool to help these users trade easily and effectively.

OctaFX is a big player, making many entrepreneurs wonder: “Can I create a forex trading app that’s as good as the top ones?”

Don’t worry! This blog is like your guide to climbing the digital mountain.

We’ll talk about understanding the market and making a user-friendly app, sharing the secrets to creating a great forex trading app that can compete with the best.

Come along as we explore the technical stuff and the steps to make a forex trading app like OctaFX that users will enjoy.

But first, let’s ask: Is it a smart move to invest in making a forex trading app?

To figure that out, let’s start by understanding the basics of forex trading.

What is Forex Trading?

Forex trading, also called foreign exchange or FX trading, is the buying and selling of currencies from different countries. It’s like a global marketplace where currencies are traded against each other, similar to how stocks or bonds are bought and sold.

Imagine yourself preparing for a trip to Europe. To buy things there, you exchange your US dollars for Euros – that’s like a simple form of forex trading.

Now, imagine this happening a lot more on a big scale. Banks, businesses, and individuals join in to guess currency values, protect against risks, or make international transactions easier.

Let’s go over some important points to gain a better understanding of forex trading:

- Forex is the biggest money market ever, trading over $6 trillion daily, way more than the stock market. This means there are always lots of buying and selling chances for currencies.

- Unlike stocks traded on places like the NYSE, forex doesn’t happen in one central spot. It goes on between different banks and financial groups, making it more flexible but sometimes not so clear.

- In forex, you never just buy or sell one currency. You always trade one against another, like USD/EUR or GBP/JPY. The first currency in the pair is the base currency, and the second is the quote currency. The price shows how much sidekick currency you need to get one unit of the main one.

- Money values can go up and down fast because of how countries are doing, politics, and social stuff. This makes forex trading a bit risky, but it also gives you a shot at making a good amount of money.

Make sure to check things out, understand the possible dangers, and don’t put in more money than you can afford to lose.

**Forex trading has various strategies—some short-term, others long-term with fundamental analysis.

With the right strategy and a reliable broker by your side, your forex trading journey can be both exciting and rewarding. So, explore the paths, choose your pace, and find your guide.

Why Should You Develop a Forex Trading App?

Deciding if you should create a forex trading app depends on what you want to achieve, what you have available, and checking out the market. Let’s look at the good and not-so-good parts:

Benefits of creating a forex trading app:

- Big opportunity: The forex market is the world’s biggest money market, trading over $6 trillion daily.

A special app that brings something unique could get a lot of users from this vast market.

- Increasing need: More and more people, especially younger ones, like using their phones for money.

If you make a good forex trading app, you can benefit from this growing trend.

- Easier access: Apps can make forex trading more accessible to a broader audience than traditional platforms, potentially attracting new users who might not have considered it before.

- Make money directly: You can earn money by charging fees, having premium memberships, or selling extra features in the app.

- Building your brand and promoting: If people like your app, it can make your brand look better and attract more investors or partners.

Challenges of Forex Trading:

- Tough competition: Many forex apps are already out there, so standing out is hard. You need a unique selling proposition and a strong marketing strategy to compete.

- Technical challenges: Making a safe, reliable, and user-friendly trading app needs a lot of tech skills and resources.

- Regulatory compliance: Dealing with money rules, privacy laws, and keeping things safe can be tricky and expensive.

- Handling risks: Forex trading is risky, so your app needs strong features to manage risks and keep users safe from losing money.

- Always updating: The financial landscape and technology evolve rapidly, requiring continuous updates and improvements to stay relevant.

Ultimately, deciding to make a Forex app is up to you and how much risk you can handle. Check what you have, look at the market, and make a solid plan before you start.

Key Features of Great Forex Trading Apps

Making a Forex trading app is tough because there’s a lot of competition! To be the best and get users, your app needs to offer an exceptional experience with features that work for different people and ways of trading.

Here are some important things that make forex trading apps great:

Important Features:

- Easy-to-Use Design: A simple and friendly layout that’s easy to understand, with clear buttons and simple ways to find important stuff.

- Real-time Market Information: Accurate and current forex rates, charts, and financial news to help you make smart decisions.

- Quick and Easy Buying and Selling: It should be fast and simple to buy or sell money, with different options and tools to manage risks.

- Technical Analysis Tools: Tools for detailed analysis, like fancy charts, technical signs, and drawing tools.

- Lists to Watch and Alerts: Personalized watchlists and price alerts to track specific currencies and stay updated.

- Security and Reliability: Strong safety features, coded data, and dependable performance.

- Multiple Devices Support: Availability on major platforms, whether it’s an iPhone or Android, so more people can use it.

Advanced Features in Forex Trading Apps

For forex apps, having basic features like watching the market, placing orders, and using charts are important. But to be special in a tough market, consider adding some cool features for experienced traders.

- Trading Signals and Insights: AI-powered or expert-derived trading signals and market analysis for better decisions.

- Level 2 Order Book: See detailed bids and ask for orders for a deeper market view.

- Margin Trading: Give experienced traders options to strengthen gains (and losses).

- News Feeds and Sentiment Analysis: Get news and see market feelings.

- Test and Improve: Tools to test and improve trading strategies with old data.

- Multi-account Management: Ability to manage multiple trading accounts from a single platform.

- Demo Account: Practice with fake money before risking real cash.

- Educational Resources: Built-in tutorials, eBooks, and educational videos to help users learn about forex trading.

- Personalized Settings: Customization options for charts, layouts, and trading preferences.

- Customer Support: Get quick and helpful help with questions or issues.

While deciding the ‘best’ features, consider what your users want and how they trade.

Focus on what your users need to make their trading experience great.

By having the important stuff, cool extras, and things your users love, your Forex app can be the favorite in the market.

Tools and Technologies to Develop a Forex Trading App

To build a forex trading app, you need a strong set of technology tools to manage complicated financial data, get updates in real time, and make secure transactions.

Here’s a breakdown of important tools and technologies to think about:

Programming Languages and Frameworks:

- Mobile App Development:

- Native: For native iOS and Android development, choose Swift or Objective-C. For Android, use Kotlin or Java. They work best for each platform.

- Cross-platform: Using Frameworks like Flutter or React Native. Let’s build apps for both iPhone and Android using just a single code, saving time, cost, and resources.

- Backend Development: To handle server-side tasks and process data, languages like Python with Django or Flask frameworks are popular due to their scalability and quick development capabilities.

APIs and Data Feeds:

- Financial Data APIs: Connect with trustworthy APIs like Finnhub, Quandl, or Xignite to get real-time and past market info, currency rates, and economic indicators.

- Trading APIs: Link up with brokerage APIs such as Interactive Brokers or MetaTrader to allow direct order placement and manage accounts in your app.

Databases and Storage:

- NoSQL Databases: MongoDB or Couchbase stores unorganized financial info, such as market updates and trading records.

- Cloud Storage: Use cloud storage services like Amazon S3 or Google Cloud Storage for safe and expandable data storage and backup.

Security and Reliability:

- User Security: Ensure users are safe using secure authentication methods like OAuth 2.0 and authorization with 2-factor authentication.

- Data Protection: Keep sensitive info, like passwords and money details, safe by encrypting it when moving or storing it using trusted methods.

- Compliance: Following Rules: Ensure your app follows important financial rules and privacy laws, such as PCI DSS and GDPR.

Supplementary Tools:

- Charts: Use libraries like Chart.js or TradingView for cool and customizable market visuals.

- Push Alerts: Add push notifications to tell users about live market stuff and trades.

- Stats and Reports: Check what users do and how the app does with tools like Google Analytics or Firebase for a better app experience.

**Don’t forget, the tools and tech you pick depend on what your app needs, who’s using it, and how much you can spend. Think about what you need to make a safe, good, and easy-to-use Forex app.

How do you develop a Forex Trading App like OctaFX?

To make a forex trading app like OctaFX, you must plan carefully, execute your plan well, and maintain it. Here are the main steps to help you do it:

Define Your Target Audience and App Goals:

Who will use your app? Beginners, experts, or specific regions? This helps you figure out what your app should offer.

What’s the aim of your app? Outshine Quotes, Pocket Option, or OctaFX, bring something unique, or focus on a specific group? Having clear goals helps map out how your app will improve.

Research and Understand the Competition:

Look at Quotex and other popular forex trading apps. Find out their strengths and weaknesses, features, user interface, and marketing strategies.

See if things are missing in the market. Are there things people need that no one is offering or groups that aren’t getting enough attention that your app could help?

Choose Your Technology Stack:

- Mobile Platform: Native development (iOS/Android) works best but needs different codes. Or use Flutter or React Native to save time and effort with one code for both.

- Backend Technology: Python with Django or Flask is good for handling data and tasks on the server.

- APIs and Data Feeds: Connect with reliable financial data sources like Finnhub or Quandl for up-to-date market info and apps like Interactive Brokers to handle buying and selling.

- Security and Compliance: Use strong methods to keep things safe and follow the rules for finance and privacy.

Design and Develop the App:

- Make user experience a priority: Design a simple, easy-to-use interface for trading and analysis.

- Focus on key features: Pay attention to important tools like market watch, order placement, charts, news updates, and risk management.

- Think about advanced features: Consider adding features like trading signals, a level 2 order book, margin trading, and educational resources to appeal to experienced traders.

- Build a secure and trustworthy backend: Ensure data integrity, transaction processing, and server stability.

Testing and Quality Assurance:

- Thorough testing is important: Test functionality, performance, security vulnerabilities, and device compatibility.

- Get user feedback: Let some people try it out before it officially comes out. Their feedback helps make your app better before it’s out there.

Launch and Marketing:

- Prepare your app for the app store submission: Follow the store rules and make your app look good on the store page.

- Plan a marketing strategy: Use social media, ads, and content to reach your target audience.

- Provide customer support: Give good and quick help to make users happy and keep them using your app.

Ongoing Maintenance and Updates:

- Keep your app up to date: Fix bugs, add new features, and adapt to changing market trends and regulations.

- Watch user feedback and data: Use data to see how people use your app and improve it based on their needs.

- Maintain security and compliance: Know the latest rules and ensure your app stays secure to protect user data.

Extra Tips:

- Stand out from Quotes, Pocket Option, or OctaFX: Have special features, good prices, or focus on a certain group.

- Make a strong brand: Make a brand people remember and trust.

- Work with banks: Team up with brokers or banks to reach more people and be more trusted.

If you follow these steps and stick to your plan, you can make a forex app that can compete with OctaFX and do well in the tough financial market.

Also Read: How to Build a Stock Trading Platform?

How Much Does it Cost to Build a Forex Trading App?

Unfortunately, there’s no one-size-fits-all answer to the cost of building a forex trading app. It highly depends on various factors, such as:

Choosing Features:

A simple app with basic features like watching the market, placing orders, and charts costs less than a complex one with advanced stuff like AI-powered trading signals, margin trading, and a level 2 order book.

Technology Stack:

Native development for iOS and Android offers the best performance but costs more than cross-platform solutions like Flutter or React Native. Deciding on server stuff, like Python with Django or Flask, also affects costs.

Building Your Team:

Having your team of developers, designers, and QA experts costs more than outsourcing certain aspects or hiring freelancers.

Location and Rates:

Costs change greatly based on where you get the work done. It’s more expensive in North America and Europe than in places like Eastern Europe or Asia.

Following the Rules:

Making sure your app follows finance and privacy laws, like PCI DSS and GDPR, adds work and cost.

Marketing and Maintenance:

Launching and promoting your app involves marketing expenses, while ongoing maintenance and updates require additional resources.

Here’s a rough figure of possible costs:

- Simple forex trading app (MVP): $50,000 – $75,000

- Medium-complexity app with advanced features: $75,000 – $200,000

- Highly complex app with cutting-edge features: $200,000+

Check out some tips & tricks to handle costs:

- Begin with an MVP: Make a basic version with important features and get feedback before making it more complex.

- Think about outsourcing: Find experienced developers or teams in places with lower costs.

- Use open-source stuff: Take advantage of free tools and libraries to save on development costs.

- Prioritize security and rules: Don’t skip on security or following rules, as it can lead to costly consequences later on.

Note: Keep in mind that creating a Forex app is a long-term plan. The initial development cost is big, incl. ongoing maintenance, updates, and marketing.

Summing Up

To build a good business, you need creative solutions. So, think about hiring dedicated developers for your Forex app. If you’re already in the FX brokerage, facing challenges is nothing new, and tackling the complex task of developing a forex application should not be scary.

The forex trading app market is promising, but it’s tough and competitive. Your app needs to be special, and given the strict data security regulations, the development process can be tricky.

As a well-known mobile app development company, we’re here to assist you.

If you’re searching for the best developers to make your Forex app, why not reach out to us?

Our group of skilled developers and development teams has successfully delivered several apps for forex trading, stocks, blockchain, and AR/VR integration, many of which are growing in the market today!

FAQs

Follow the below steps to build a forex trading application –

1. Market Research

2. Define Features and Functionality

3. Choose a Platform

4. Select a Technology Stack

5. Integrate with Forex APIs.

6. Implement Security Measures.

7. Compliance with Regulations.

8. User Authentication and Authorization

Check if OctaFX’s trading app is legal where you are. It’s regulated in Cyprus, but some places, like India, have concerns. Research your local rules and talk to financial advisors before using any forex app, including OctaFX.

(Source: OctaFX)

Building a good forex robot for free is hard and risky. It needs a lot of programming skills and financial knowledge. Free tools have limits, and mistakes can cost you money. Trying demo accounts or getting advice from pros might be safer.

Meta Trader 4 and 5 are popular for powerful tools. Others like IG Trading and TD Ameritrade’s think or swim are good too. The ‘best’ app depends on what you need for your trading.

To become a Forex Brokerage, check the following steps –

1. Know Your Audience and Analyze the Market.

2. Legal Procedures.

3. Choose the Trading Platform.

4. Build Your Brand.

5. Create a Website.

6. Connect with a Trusted Liquidity Provider.

7. Connect with the Payment Processor.

8. Follow the A-Book Broker Model.

Forex robots can be profitable, but it’s not guaranteed. They trade automatically with set rules. Market changes, surprises, and the robot’s limits can lead to losses. They’re tools for experienced traders, not surefire profits. Before using any robot, do good research, know what it can’t do, and manage risks carefully.

Forex trading app legality in India is complex. Some international apps may not be registered. Stick to SEBI-registered brokers like Zerodha, Kotak Securities, or Angel Broking for legal and reliable access. Their platforms usually work with popular tools like MetaTrader, making it legal and reliable to trade forex in India.

Remember, do your research and talk to financial advisors before investing.

Leave a Reply

Hire Dedicated Forex Trading App Developers

Get your app on time and within budget.

.png)

.png)

.png)

Leave a Comment