The software has penetrated all aspects of our lives in this digital age, with individuals and businesses relying on it to carry out daily tasks. It has become omnipresent in the growth stories of startups and enterprises on a global scale in a way that software helps businesses transform digitally by going in for automation and streamlining their existing processes.

According to Statista, revenue in the software market is expected to grow at an annual CAGR of 6.50% resulting in a total market volume of USD 812.90 billion by 2027, with most revenue generated in the US.

Such immense potential, backed by steady growth, makes the software a lucrative business for entrepreneurs keen to set up a business focused on digitally transforming industries. What works in their favor is that the industry also has immense scope for new entrants with good ideas and a passion for success.

If you are new to the software industry and want to change the world through the power of software, you are at the right place. This guide is for entrepreneurs who wish to start a business in software and the steps needed to begin one.

So without any further ado, let’s get started.

But before we see how to start a software company, let’s first define what it is and how it operates.

What does a Software Company do?

Do you know what Whatsapp, Pinterest, and Meta have in common? They are prominent software companies that began as startups and have grown into giants. With many companies on the rise, competition has grown; year after year, thousands of entrepreneurs worldwide are setting their eyes on becoming the next big success in the highly competitive software industry.

A software company maintains applications, products, frameworks, or other components using the latest technologies for consumers and businesses. Their day-to-day operations include product upkeep, programming, system services, and Software as a Service (SaaS). They typically generate revenue by offering programming services, subscriptions, software licenses, maintenance and support services, etc.

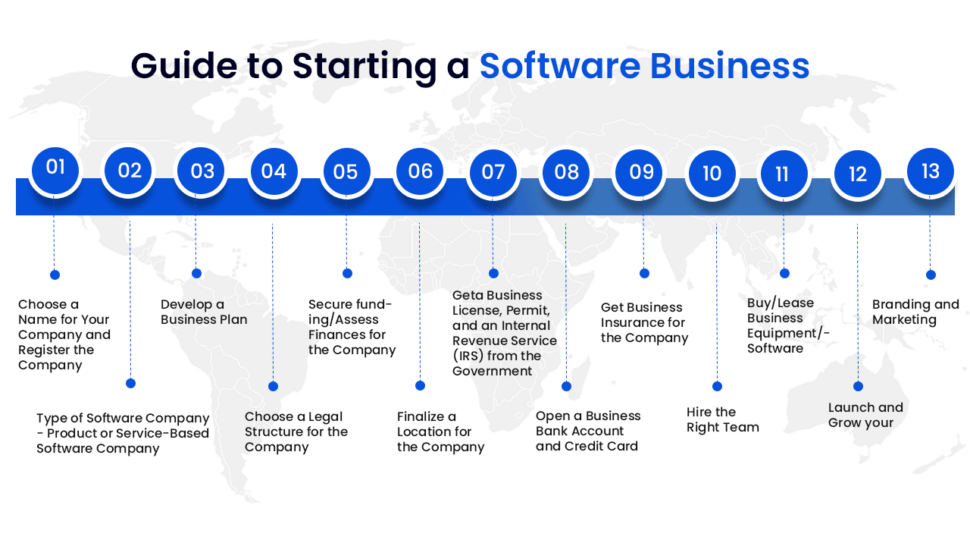

Guide to Starting a Software Business

Planning is fundamental for any business. Starting a software business also involves proper planning, market research, acquiring knowledge in different aspects, making financial decisions, etc. The following are steps you can follow to start a software business.

1) Choose a Name for Your Company and Register the Company

2) Type of Software Company – Product or Service-Based Software Company

3) Develop a Business Plan

4) Choose a Legal Structure for the Company

5) Secure funding/Assess Finances for the Company

6) Finalize a Location for the Company

7) Geta Business License, Permit, and an Internal Revenue Service (IRS) from the Government

8) Open a Business Bank Account and Credit Card

9) Get Business Insurance for the Company

10) Buy/Lease Business Equipment/Software

11) Hire the Right Team

12) Branding and Marketing

13) Launch and Grow your Business

We hope the following steps can help you put your best foot forward, map out the specifics of your business, and ensure your business idea is well-planned, registered, and legally compliant.

1) Choose a Name for Your Company and Register the Company

Since you plan to start a software business, choosing a business name is the first step. It is the most critical choice since the company name lasts a lifetime of the business. Select a name that reflects what you stand for, your brand conveys meaning and is memorable. The following are a few tips you can follow in choosing a name.

- Keep it simple: The best names in business are short, unique, easy to remember, and spell memorable—also, research potential business names on social media platforms.

- Name availability: Check if the name is available and not trademarked by federal and state. Also, check if a suitable web domain name is available and secure the name before anyone else does.

- Think of how you plan to market it: The name must reflect your brand and focus on what your software company will provide.

2) Type of Software Company – Product or Service-Based Software Company

As an entrepreneur, you can choose two routes: start a service-based software company where you can showcase software skills and knowledge and provide services like Cognizant, IBM, or Accenture, or a product-based company where you can sell products to people like Google, Facebook, and Adobe, etc.

Both business models are equally profitable. However, both types of software companies i.e., service and product-based companies, need managing people to an extent and depend on supply and demand. Make sure to consider the pros and cons of both before starting a software development company.

3) Develop a Business Plan

After you have finalized the type of service and name for your business, it is time to organize a business plan for your software company that can be an effective strategy for growth, raising capital or funding for your business, and reaching your goals. You can look at the following essential facets of your business plan.

- Company overview and summary: This section summarizes your entire business, history, mission statement, and details such as employees, leadership, and operations type of services you provide.

- Industry analysis: You can give essential information about the software industry by conducting market research and trends you wish to follow for your company.

- Customer analysis: In this section, you can give details of the target audience and demographics. For example, provide a specific job title, the industry they work for, etc.

- Competitor Analysis: In this section, you can document who your competitors are and how you plan to have a competitive edge over them.

- Marketing and Operation: An essential section of all. In this section, you can give your strategy to attract potential audiences and your marketing campaign plans that address the 4Ps.

- Product: Finalize the services or products you wish to offer

- Prices: The prices you want to set for your services or products.

- Place: Where do you plan to begin a business and eventually get sales?

- Promotions: What promotions do you plan to implement to get potential customers/clients on board?

- Financial: This section contains the cost estimations related to the company’s operations, which include staffing, development, manufacturing, marketing, and other operating expenses.

4) Choose a Legal Structure for the Company

You get to choose the structure of your software company and register it legally with your business name in the state/ country where you wish to operate your business from. The following are the most common legal structures that you must know.

Sole Proprietorship

This system is where a single owner is responsible for all debts and obligations, and controls and manages the business. The main advantage of a sole proprietorship is it is simple to create, the owner is in total control and inexpensive. However, the disadvantage is that the owner is liable for all debts and obligations.

Partnerships

This is the most popular legal structure of all among entrepreneurs. You agree with two or more like-minded people and start a software company as a partner. They are liable to share both losses and profits of the business.

The main advantage of this model is that it is easy to set up, and partners share in the losses and profits of the business. The disadvantages of the partnership are that partners are liable for business debts, and disagreements may arise between partners, which may be challenging to resolve.

Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a hybrid business structure that protects the owner from personal responsibilities for the company’s debts and liabilities. One or more individuals can own an LLC, corporation, partnership firm, or other LLCs, where each member holds a certain percentage of ownership of the LLC.

Advantages include flexibility, tax benefits, and protection from personal liability. The disadvantages include lack of leadership, non-availability in certain countries/states, and varying self-employment taxes.

C and S Corporation

C and S Corporations are business entities that provide limited liability protection. Though they have similarities, they come with their differences. For example, C corporation profits are taxed twice; the company pays a corporate income tax, and the shareholders pay a federal tax on the dividends received. This double taxation can be avoided by choosing S corporate status.

S corporation is similar to a sole proprietorship or partnership, where profits or losses are passed directly from the corporation to the shareholders. An S corporation is most popular with small businesses owing to tax savings, and C is more prevalent among giant corporations due to the flexibility to raise capital.

It is up to businesses and owners to determine the best model per current needs and future business plans. Therefore, research in detail regarding the legal aspects, and if you are struggling to make up your mind, it is a good idea to consult a business or legal advisor.

5) Secure Funding/Assess Finances for the Company

Raising funding for your business is the crucial step you need to take up next, especially if the amount you wish to raise is beyond bank credit. You can also seek business funding by joining accelerator programs, crowdfunding, venture capital funds, bank loans, personal savings, family and friends, angel investors, credit card financing, etc. Angel investing is the most common right now, where individuals provide capital for early-stage funding for businesses with high growth potential.

We will be exploring the models in detail towards the end of the blog.

6) Finalize a Location for the Company

You can finalize a physical office location, build a remote team, or combine both. Consider the following if you rent, lease/ buy a physical location.

- Contact a commercial real estate agent.

- Choose areas in and around the location of your choice for lease

- Seeking help from your network who can help you find a suitable space

- Search for real estate/office space for rent online

7) Get a Business License, Permit, and an Internal Revenue Service (IRS) from the Government

Next, you must acquire a business license to operate your business legally. Then, depending on the location of the software company, you will have to register with the local, state, and federal governments, as they have different license and permit requirements per the business.

The following are some documents that must be prepared before registering.

Article of incorporation and operating agreements

Registering with the government is a must to become an officially recognized business. In addition, the company must have an article of incorporation document that includes the name of the business, corporate structure, business purpose, and other vital information about the company.

Employer Identification Number (EIN)

After registering your business with the government, you must next register your software business with the Internal Revenue Service (IRS), which will issue an Employer Identification Number (EIN) that you will need if you wish to open a business account in a bank.

If you have no employees on the payroll, you need not apply for an EIN; you need your social security number. But in the future, if you hire employees, you will need an EIN to keep track of payroll tax payments.

Sales Tax License

Sales tax will be collected and remitted per your software company’s location. The fee structure may vary from state to state, you must research the requirements and collect a sales tax license. A sales tax license includes registration with a state revenue department and applying for a seller’s permit if you wish to sell/provide services.

8) Open a Business Bank Account and Credit Card

Having a bank account in the name of your software company is a simple process involving the following.

- Identify and finalize the bank.

- Provide and submit all necessary information and documents along with the application form (software company’s incorporation article, address proof, government-issued id cards, social security number, etc.)

- Discuss business needs and forge a fruitful relationship with the bank.

Next, applying for a business credit card for your company through the bank or a credit card company is essential to separate your personal and business expenses. Provide the required business and personal details, and once you get the business credit card, you can use it for business purchases. In addition, a good credit history can help secure loans and future credit for your business.

9) Get Business Insurance for the Company

Purchasing the right business insurance is necessary for any business before the official launch. Dealing with unforeseen incidents such as theft, property disputes/damages, and customer lawsuits are challenging, therefore, you need to ensure that your business is adequately protected.

There are various types of business insurance that you can opt for, like the following.

General Liability Insurance:

It provides coverage for the business in case of any unforeseen circumstances like bodily harm, property damages, personal injury, or harm to reputation. If a lawsuit is filed, legal, property, medical, and settlement costs are covered.

Errors and Omissions Insurance/ Professional liability insurance:

It provides businesses coverage when they are sued for errors or mistakes in consulting or services as promised.

Product Liability Insurance:

This provides software business coverage if the product causes physical/mental harm to the customer. For example, this insurance can be claimed for damage and injury caused by products due to bad design, defects, or improper instructions.

Worker compensation insurance:

This insurance can protect the software company from lawsuits by employees in case they get sick or hurt while on the job.

There are many other types, which you can discuss with a good insurance advisor/company, who will recommend the right fit per the business’s needs.

10) Buy/Lease Business Equipment/Software

Running a business can be overwhelming for you, and this is where 3rd party B2B vendors/software comes into the picture. They help you to run your business better, from HR operations to providing the best software/hardware support. Depending on your budget and business type, you can invest and buy the necessary software and hardware.

Choosing the right B2B vendor is crucial as they have access to critical and sensitive business data. In addition, finalize the right vendor with a sound track record with existing clients to see the growth they have helped achieve.

Only some businesses will need a particular type of vendor, but there are common products or services that most companies need. Finding suitable options can ensure you get the best software and hardware for leasing/renting your business.

11) Hire the Right Team

The workforce you hire for your company plays a significant role in the success of your business. As the founding member of your company, lay the foundation and dynamics for how you plan to operate your software. You can also consider how you wish to hire – permanent employees, outsourcing or freelancing.

The team you hire must be highly experienced and skilled to help grow your business. Find people who share your vision and are passionate about working on new challenges. When filling role requirements, consider the potential candidates’ knowledge, ability, and skill. Ensure the hiring team discusses the responsibilities, tasks, and goals upfront before hiring anyone.

12) Branding and Marketing

Before you begin selling your products or software services, you need to build up your brand to get people to come for business once you launch your business.

Company website:

Bring your business online and build an official website. Most customers and clients browse online about your offerings first as it is proof that you are a legitimate business. In addition, it is the most effective way to showcase your business, the services you offer, the history of the company, and contact information to potential customers and existing customers. Remember, the look and feel of the website affect how your target market will perceive you.

Social media:

Social media platforms must be used effectively to spread the word about your business and what you offer. It can be an efficient promotional tool to run discounts and provide the latest updates to followers once you launch. Choose the right platform based on target audiences, such as Facebook, LinkedIn, and Twitter, to help them interact with your company.

Logo:

Develop a good logo for your software company to help people identify your brand. Be consistent with its use across all platforms, as a suitable logo can help increase your brand’s awareness and customer trust.

CRM:

A well-thought-of CRM solution can do wonders for your business and help you communicate with the right audience. It allows you to store customer data, drive insights and improve how you can market to them.

Keep all digital content and assets up to date, relevant, and interesting about your business. It is essential to have a significant online presence that will have a leg up to start our strong.

A sound marketing plan can go beyond the launch, as it helps build a clientele by continually getting the word out about your business.

13) Launch and Grow your Business

It’s time to launch your company formally. Once you have followed the steps above, you are in a great position to build a successful business. However, the launch and first sales begin a long road ahead.

To make profits and stay afloat, you must keep growing, which will take time and effort. Collaborate with established companies and reach out to other firms in exchange for projects or services.

As first-time entrepreneurs, we know a lot is on your mind. However, you might also be intimidated by the amount of work you have ahead that you have to get through to get your business going. Moreover, today’s market changes daily, with trends and marketing practices evolving with consumer behavior.

In the next section, we will discuss some tips to help entrepreneurs on their business journey.

Ten Tips for First-Time Entrepreneurs

We have prepared some tips that can help you on your entrepreneurship journey and launch a successful business.

1) Find your Niche

2) Begin with a Well-Thought-of Plan

3) Overcome the Urge to Quit

4) Develop the Team’s Skills and Techniques

5) Trust is an Essential Factor

6) Invest in Business Growth

7) Be Committed to Client Success

8) Provide Top-Quality Customer Service

9) Keep Networking

10) Take Risks

1) Find your Niche

As a first-time entrepreneur, identify a suitable niche and become a pro in that segment. Then, get a strong foothold in that space and capture a significant market share. Only then think of expanding to new markets.

2) Begin with a Well-Thought-of Plan

Before creating a software company, thoroughly research the industry and target market. Then, evaluate your finances and create a prudent, accurate, and concrete business plan.

3) Overcome the Urge to Quit

We know how difficult it can be to withstand tricky periods-especially in the beginning, as it can easily lead to burnout. So fight the urge to quit and find solace in small things that can make you happy.

4) Develop Team’s Skills and Techniques

Talent must be valued on par with skills. One of the main goals should be to create a work environment that supports high individual and team productivity. In addition, adapting to changes and constantly updating skills and methods is necessary as technology evolves.

5)Trust is an Essential Factor

A software business is about more than just making profits. It is a long game where profits alone do not measure up to a company’s value. The trust formed between customers, employees, and the community plays a role in the success of a business.

6) Invest in Business Growth

Availing investment is an essential step for business growth. Invest in the capital, projects and departments in the long run for better results.

7) Be Committed to Client Success

In addition to getting new clients, you must defend, grow revenue and extend services to existing clients. A team must continuously monitor existing clients, send them updates, conduct satisfaction surveys, etc.

8) Provide Top-Quality Customer Service

To make your company shine and grow, you don’t need just the perfect products or service but excellent customer support staff available 24/7 to make customers feel valued and to address issues that may arise. From this comes positive reviews and fantastic referrals.

9) Keep Networking

It helps to expand connections and learn from individuals who have accomplished their goals. This positive networking also allows you to learn from experts, build social interactions and gain investors if your business model is profitable.

10) Take Risks

One of the key ingredients for success is taking risks. So do not shy away from risks, fearing failure. Know one thing; successful businesses are built on a foundation of risk and believing in ideas. So stay focused and determined, and never let other people’s opinions and setbacks get you down.

How to Raise Capital For Your Business as a First-Time Entrepreneur

Once you start a software business, funding the company is one of the most critical factors. As a founder, one of the essential things of all is fundraising which is a one time or ongoing process if you wish to expand.

Most entrepreneurs believe they must save up and invest their capital in starting a business. But we will discuss other ways to raise money for your company below. However, before you begin your fundraising journey, lay the groundwork for research, assess the costs, and estimate the cash you need.

1) Bootstrapping

2) Crowdfunding

3) Angel Investments

4) Venture Capital

5) Bank Loans and Lines of credit

6) Accelerators and Incubators

7) State Grants

1) Bootstrapping

Bootstrapping, or self-funding, is the best way to begin when you are just starting a business. You can invest from your savings or have friends and family support. It is the easiest way to raise money owing to fewer formalities involved, and they are flexible with interest rates too.

When you invest your own money, you are tied to the business, and at a later stage, your investors will see this as a commitment to succeed. Of course, this is suitable only if the initial requirement is low and you are a small software development company. But if your company needs massive inflow right from day one, there may be better options. Also, bootstrapping is about stretching the resources to finance and otherwise as much as possible.

2) Crowdfunding

This is a popular way of funding a company or startup that has recently gained much popularity. It is like taking a loan, contribution, or investment from one individual or many simultaneously. As an entrepreneur, you put up a detailed description of your business on a crowdfunding platform or website accessed by investors. You mention the goals, profits, how much funding you need, reasons, etc., which they can read and give money to if they like the idea.

Some may invest in exchange for profit or a reward, and some may not expect anything in return but support your idea. You can try crowdfunding platforms like Kickstarter, Indiegogo, CircleUp, RocketHub, Fundable, and Crowdfunder, which can guide your company and raise capital in all stages, right from pre-seed to Series A.

An advantage of this funding is that it helps market your product or service and finance. It cuts out brokers and money lenders by putting the funds in the hands of common people. It can also attract venture-capital investments in the long run when the company is successful.

3) Angel Investments

Angel investors are cash-strapped businesspeople keen to invest in early-stage companies. They work in groups of networks, screen the proposal vigorously, and invest only if they see scope for growth. They also offer mentoring and advice along with capital.

This form of investing usually occurs in the early stages of the company, where the investors can demand anything from 20 to 50 percent stake in the companies they help, which is determined strictly by negotiation. Naturally, they prefer taking more risks for higher returns.

Prominent companies like Google, Alibaba, and Yahoo choose this route to stand as the corporate giants they are today. Some of the top angel investors currently in the US include Alumni ventures, and Sand Hill Angels. Keiretsu Forum, StartEngine as per Crunchbase.

4) Venture Capital

The next best way to finance your company is through Venture Capital. They are primarily huge investment companies comprising wealthy individuals who are on board as investors and get equity with a certain percentage.

These companies invest in high-growth startups or companies with massive potential for their investors. VCs provide mentorship, expertise, evaluation and help the company sustain and grow. They exit once there is an IPO or an acquisition. Also, chances of raising money this way are high if your business has projected growth potential and a competitive edge in the target market.

But, a downside is that VCs have a short leash regarding loyalty as they will look forward to recovering their investment quickly. If the product takes longer to market, they may not be interested in funding. Also, they get a say in your business; if you are not interested in mentorship, there are better options for you.

Some famous venture capital firms are Sequoia Capital, Accel, Tiger Global Management, Andreessen Horowitz, Founders Fund, Benchmark, Index Ventures, Bessemer Venture Partners, GGV Capital, and IVP.

5) Bank Loans and Lines of credit

Banks are the first places for entrepreneurs, but they are hard to secure for businesses with less than two years of tax records. This is because banks have stringent eligibility criteria like excellent credit scores and collateral requirements before approving a business loan.

The best avenue for debt financing is to go through US small business administration (SBA) microloans or from NBFCs are Non-Banking Financial Corporations to get started. A point to note here is that the loan amount, interest rates, repayment tenure, and type can vary from bank to bank and you will need personal collateral or guarantee, not just a credit score.

6) Accelerators and Incubators

This is an excellent path to consider depending on the industry. They are programs offered to early-stage companies which normally run for a few months with operations, mentorship, marketing, and access to capital. Companies can enter them for a fixed period, work with emerging brands in the industry, and make good connections with investors, mentors, and fellow startups.

Companies such as Airbnb and Dropbox began their innings with an accelerator called -Y Combinator in the US. Some of the US’s top famous incubators and accelerators are Y Combinator, TechStars, 500 Startups, MassChallenge, SOSV, Plug and Play Tech Center, Innovation Works, Alchemist Accelerator, etc.

7) State Grants

When raising money for your company, you can apply for government grants and tax incentives available for startups to boost innovative companies. In addition, business lending funds and a dedicated portal for Government grants are available for local software companies. If you comply with the eligibility criteria, apply for them as they are less competitive than other modes or federal grants.

Once you have identified your capital source, the next step is getting funding. A solid and persuasive pitch, regardless of the route you choose, will be needed with a clearly explained idea, background, market share, and exit strategy.

Also, seeking advice and feedback on your pitch is an excellent way to start. So, stay in contact with everyone on the list and keep potential investors in the loop, even if you have yet to receive funding initially as your business grows.

Let us now see some common mistakes you must avoid as a first-time entrepreneur.

Common Mistakes to Avoid as a first-time entrepreneur

Plenty of software companies in the market offer affordable services and solutions, but for some reason, they do not succeed as expected. It does not relate to technical and economic aspects, but there may be a few reasons a software company can fail.

According to the US Bureau of Labor Statistics, as reported by Fundera, more than 20-30% of new businesses fail in the first two years of operation, and 50% do not survive past the 5th year of running. So how to launch and run your company successfully and how to avoid mistakes from happening when you are a first-time entrepreneur is what we will find out.

- Hiring the Wrong Team

- Not Making a Proper Business Plan

- Not Understanding the Target Audience or Market

- Legal Implications

- Lack of Leadership

- Raising Too Much Money or Not Having Enough Funding

- Trying to do Everything Yourself

- Choosing the Wrong Business Model

- Undercharging the Product or Services

- Not Having Proper Contracts/Agreements

1) Hiring the Wrong Team

The team is the backbone of your company. As a first-time entrepreneur, you may be tempted to hire the people you know or hire the wrong person for the job, like hiring a full-timer for a part-timer or an employee when a subcontractor can do the same job. It can lead to problems when skills don’t match or need an upgrade while on the job.

Opting for a skilled, well-rounded team can help. Distribute responsibilities based on the skills and strength of the employee and encourage collaborative work with the help of workflow tools and techniques in the market that can help you enough.

2) Not Making a Proper Business Plan

Sometimes businesses need to start with a clearly defined plan, and entrepreneurs who skip this step may see complications. Even if it is just a single page, ensure your business plan has everything concerned right from business details, costs to operate your business, services you provide, how much you plan to sell, who is the target audience and why they should opt for your business.

3) Not Understanding the Target Audience or Market

A common mistake first-time entrepreneurs make is failing to understand the market or customers for whom they build the product. Knowing the nuances of the market can take time, and young entrepreneurs need to gain good experience in the market and the knowledge that seasoned companies have. Sometimes companies may focus on a small market to build a big business.

Having a mentor can benefit entrepreneurs or focus on what customers can help build your company. Have enough insight into competition and desires—target audience and market before launching any service or product. Then, take your time in analyzing the idea, conducting research, build an MVP, and knowing the market better to offer practical and accurate solutions.

4) Legal Implications

Each country has different business and legal laws applied to companies just starting. Studying your business’s rules is essential to begin on the right foot. Overlooking or breaking any of them as an entrepreneur can have severe implications and affect your business.

Seek advice from a legal expert or find a corporate lawyer. Have a legal team who can oversee the changes, supervise everything, and defend you in legal complications. Also, know the country’s laws so you can handle it overall.

5) Lack of Leadership

Leadership can sink or keep your business afloat and is one of the main ingredients of success that cannot go missing in a company. As a founder and creator, an entrepreneur must lay a road for employees to inspire, create a sense of ownership, and ensure goals are met with the right strategy and effectiveness. A strong team with a good leader can perform well and achieve all goals set.

Leadership and charisma must begin with you and be transmitted to other team members as your company grows. A good leader motivates workers and builds a strong team with different abilities to learn and grow.

6) Raising Too Much Money or Not Having Enough Funding

The biggest reasons businesses fail are lack of money or too much money. As a first-time founder, saying yes to investments that come your way may sound enticing. But, similarly, not having proper funds too can be alarming. The money you’ll need from the start depends on your services and the resources you have.

While obtaining finance is a massive hurdle for entrepreneurs, following a few ways to raise funds above can help you fund your venture. Also, mishandling money can be a death sentence for companies with limited access to funds. Therefore, putting money to good use and trying to do everything that can help save valuable time and money is a must.

7) Trying to do Everything Yourself

Most founders wish to do everything themselves because they have the vision. But unfortunately, they need to understand that a company is not a single-player effort but a team that trusts and builds on your company’s vision that helps them grow.

Working with a team also means you, as an entrepreneur, learn to be a leader, which is an underdeveloped skill. Leaders may need more experience to lead a team, and micromanaging as they want it a certain way – can ruin a team’s chemistry and collaboration.

8) Choosing the Wrong Business Model

Most software businesses begin as small businesses by selling their product or service to the public without considering how they must be legally organized. As a result, they end up as a sole proprietorship or a partnership co-owned by multiple people.

While both models have benefits, they come with a drawback- you are personally liable for all debts incurred by the business and business-related lawsuits. In case of debt, your business and personal assets, such as your bank account, car, house, etc., can go into the hands of the creditor (with whom you own money). Also, partners in partnerships are liable for wrongdoing by fellow partners.

A simple solution to this is forming a limited liability company (LLC) that owns and manages the business. As a result, personal liability can be avoided in case of lawsuits and significant tax benefits can be availed.

9) Undercharging the Product or Services

Another mistake most entrepreneurs make when they start is undercharging to capture more customer base. Of course, charging less or lowballing your fees than competitors isn’t going to get you more customers or business. But potential clients believe they get what they pay for, with most willing to pay more to get higher quality products or services.

The best way to know how to charge is by trying our various payment structures and methods with clients/customers and seeing what works best.

10) Not Having Proper Contracts/Agreements

Contracts can be oral or in writing to be legally binding. If you and a client have entered an agreement over the phone or a meeting and agreed to provide services to the client in return for money. It need not be put in writing, but things work fine as long as no mishap or problem occurs.

A verbal agreement can work out only if both sides of the party agree on the terms and obey those terms, but if things do not work out, lawsuits are filed. Courts are filled with lawsuits of this kind by individuals and businesses who enter into oral agreements and later disagree on the same.

It is always best to draft a written client agreement before entering into a contract as it can be a lifeline later on. In addition, if disputes occur, an agreement can show a way to solve the dispute and establish legal duties to one another. Therefore, ensure you have the services you provide in writing, when and how you offer them, how much you will get paid, etc.

Parting Words

A successful business is not built by one person but by a team. Ensure to surround yourself with mentors and experts who you can lean on and learn from. Challenge your limits, change paths, and upgrade your objectives.

Entrepreneurship is not for the faint-hearted; with the right plan and team backing you, you can have what it takes to turn your incredible idea into a tangible product. As an entrepreneur do not be afraid of failure. Mistakes are inevitable, and one of the best things you can do is learn from them and put them to good use without being hard on yourself. Learn from mistakes and pivot your business model as per need. Always keep testing new ideas, get feedback, and tweak the product or service to meet customer needs.

Build Your Software Business with Ailoitte

Mentorship plays a vital role in your software business. Surround yourself with the right team to achieve your idea’s full potential, and we-Ailoitte can help you start your entrepreneurial journey.

We are an end-to-end software development company that specializes in helping entrepreneurs like you to succeed. We help you ideate, develop, improve, and maintain your software business. We have worked closely with thousands of companies who have gone on to achieve tremendous success in their journeys.

We also provide you with the right talent you need for your project. We have a team of experts from UI/UX developers, software programmers, QA specialists, and project managers who can closely work on your needs.

FAQ

One of the essential things to do is research and get an insight into how the software industry works. Get a timeline and costs that are needed to develop software. Connecting with experienced professionals or business owners can give you valuable insights into the dos and don’ts of running a software company.

The company’s profitability depends on various factors such as the type of software you wish to produce, size, market, competition, domain, etc. SAAS companies are the most profitable now owing to a steady stream of users and widespread reach. Enterprise software companies also charge more as their target is usually other large organizations.

The amount you need depends on the type of company you wish to build, the services you offer, and the location you want to operate from. You will then have to pay office rent, hardware and software costs, employee salaries, etc. Also, you must pay taxes on the income you receive. It costs an estimated $30,000 to $150,000 as per the business needs to begin which may go up with time.

There are many ways by which a software company can make money. One of the most common ways is to make and sell software that people/companies may use. It can be a one-time purchase or a fee that can be charged on a subscription basis. In the case of SaaS, customers can pay a regular fee to access software over the Internet instead of installing it on a local device. Also, you can create add-on products or services that can complement software.

The primary reason why software companies fail is that they need a clear vision and a lack of strategy for long-term sustenance. As a result, they need more focus and direction, leading to missed opportunities and failure. Some other reasons include poor marketing, inadequate funding, and a poor customer base.

If the amount you wish to raise is beyond bank credit, you can opt for other fundraising alternatives such as finding angel investors, accelerator programs, crowdfunding, VC funding, etc.

Governments worldwide want to create more jobs and entrepreneurs to start businesses. Besides, they are proactive in granting licenses and permits as digitalization has taken over the world.

You must have a sound business plan first that validates your idea with the help of collaborating with like-minded individuals or fellow entrepreneurs. You can also approach agencies and business consultancies who can advise on how to tweak your idea to make it sustainable.

The owner of a small software company in the US can make about $40,000 to $70,000 whereas a large firm or corporation can make anything from around $100,000 to $400,000. The exact number can be determined based on revenue and the type of company.

The steps to run a software company are as follows. Choose a name for your company and register the company. Next, decide on the type of Software company you wish to begin – Product or service-based software company. Develop a Business Plan and choose a legal structure for the company. Secure funding/Assess finances for the company and finalize a location for the company. Get a business license, permit, and an Internal Revenue Service (IRS) from the government. Open a business bank account and credit card. Get business insurance for the company. Buy/Lease business equipment/software. Hire the right team and begin branding and marketing activities. Finally, launch and grow your business.

Yes, one owner can start a software company which is also called a sole proprietorship company. You can enjoy great success with proper planning, execution, and hard work.

Yes, the costs to start a software company range from $30,000 to $250,000, depending on the business scale.

.png)

.png)

.png)

Leave a Comment