The FinTech sector is a compelling and fastest-growing area that offers convenience and digitalization to traditional banking practices. Emerged by combining Finance and Technology, it consists of platforms from budgeting apps to transferring money in real-time, thus replacing conventional modes of payments and services across multiple finance domains.

With Business and Finance apps booming since the global pandemic, 5000+ FinTech companies have emerged worldwide. Per Market Data Forecast, the market is predicted to evolve further and reach a market worth of about $324 billion by 2026, developing at a CAGR of 23.41% between 2021-2026.

In addition, in-app purchases and spending revenue are expected to climb up to $202.9 billion this year, as per Statista. If these statistics tell you anything, it is the fact that now is the perfect time for businesses to step into the industry.

Now the question arises: How to build and release a FinTech mobile app in the face of fierce competition? And how to make money with a FinTech mobile app solution, as there are plenty of options.

In this blog, we will answer all the questions you have by discussing in detail the multiple facets of FinTech application development.

- What is a FinTech app

- Types of FinTech Apps

- Top Features of a FinTech App

- How to Build a FinTech Application

- Challenges of FinTech App Development

- FinTech mobile app development costs

- How FinTech apps make money.

So let’s get started.

What is a FinTech Application

FinTech or Financial Technology describes the applications that aim to automate financial services by leveraging advanced technologies to help consumers and businesses seamlessly manage their financial operations and processes.

Initially, the term was limited to the backend systems of established financial institutions, but now it includes different sectors such as banking, the stock market, investment management, blockchain, etc.

Now let’s see the different types of FinTech apps.

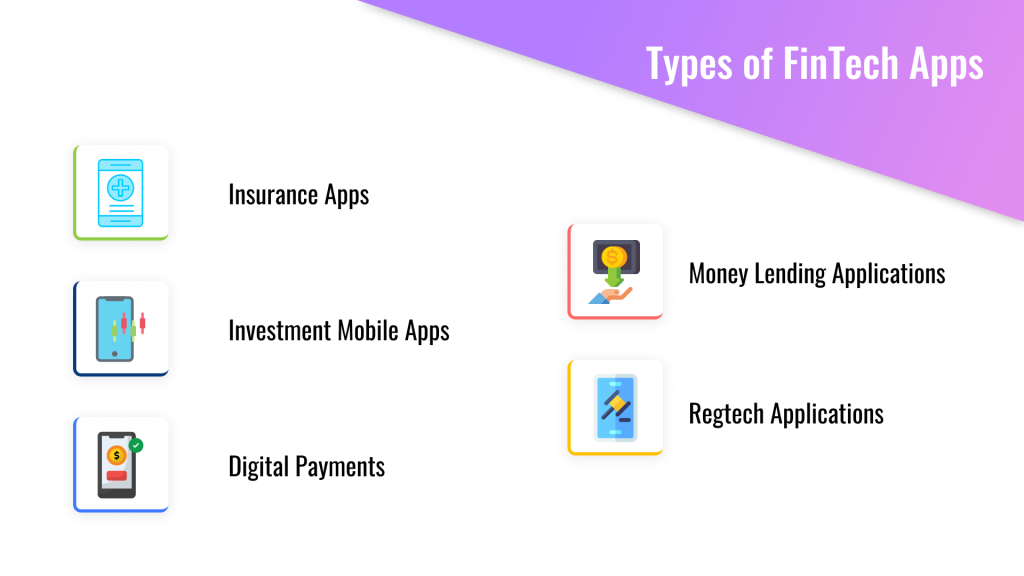

Types of FinTech Apps

FinTech apps cater to multiple industries and help consumers and businesses to carry out seamless financial services and operations. Here are a few popular FinTech applications-

1) Insurance Apps

These apps bridge the gap between insurance organizations and consumers. It helps make faster claims, perform filter-based policy searches, ease payment processing, and more. The app features include claims filing, filter-based policy search, multiple payment options, features of the policy, access to your insurance information, multilingual assistance, etc.

2) Investment Mobile Apps

Users can make stock purchases and help drive decisions that can optimize profits. In addition, users can leverage applications for stock trading, mutual funds, and cryptocurrency trading. These apps usually include features like investment accounts, market analysis, statistics, history of stock holdings, trending investment portfolios, etc.

3) Digital Payments

A digital payment platform allows consumers to pay for goods and services to vendors. At the same time, applications can benefit business owners, too, as they receive payments directly to their bank accounts without compromising security. Some features include registering and verifying bank accounts, performing transactions via UPI and NEFT, and paying or scheduling bills.

4) Money lending applications

These apps allow businesses to lend money without a financial or credit organization. Users can register on the app and share the details upon which they can avail of a loan based on credit score. To facilitate the process, the app comes with features such as credit score, bill payments, loan applications, etc.

5) Regtech applications

Regtech, a regulatory compliance technology, helps enterprises comply with laws stated by regulatory bodies. These apps help monitor tasks, regulatory changes, transactions, reporting and keep track of non-compliance alerts.

Let us now see how to build a FinTech application and the features you can include.

Also Read – App Development Cost

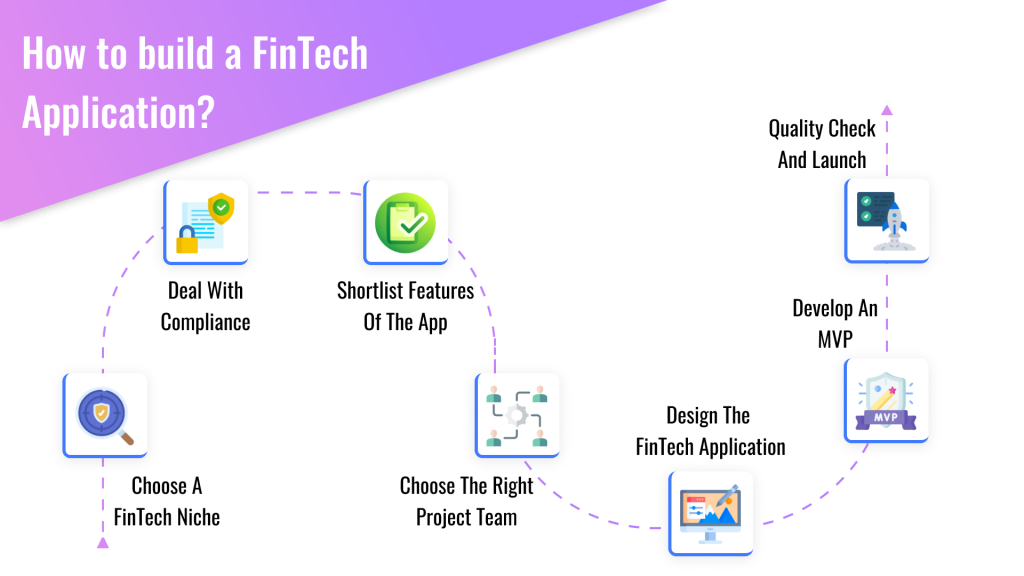

How to Build a FinTech App?

Now that you have seen the different types of apps and decided on a niche for your business, let’s look at an easy step-by-step guide to building a Fintech mobile app.

1) Choose a FinTech niche

We saw different types of FinTech apps above. You must make an informed decision about your niche before investing in FinTech app development by analyzing your target goals, features you wish to include, audience, pain points, and challenges you wish to address. This will give you a clear picture of what you need.

2) Deal with compliance

FinTech mobile apps must comply with all the latest industry requirements, potential governing rules, constraints, privacy legislation laws, and regulations in the location the application will be in.

Some of the privacy legislation laws include

- The Lei Geral de Proteção de Dados (LGPD)

- California Consumer Privacy Act (CCPA)

- General Data Protection Regulation (GDPR)

- Personal Injury Alliance (PIA)

Some essential examples are digital signature certifications and Know your Customer (KYC), Anti Money Laundering(AML), etc.

3) Shortlist features of the app

Let us look at some must-have features of the FinTech app.

- Security

All security measures must be in place to safeguard an app against any intrusion or suspicious activity and protect the user’s personal information. FinTech companies can ensure a hack-roof experience by using functionalities like

- Encryption

- Two-way authentication

- Fingerprint or face scan security

- Log-in through OTP, and

- Dynamic CVV2 codes.

Additionally, the app must comply with all regulatory measures and privacy laws.

- Personalization

Grabbing users’ attention and making them feel special is very important for offering a tailor-made FinTech app. To enable this, businesses typically use AI to help analyze usage patterns and offer relevant inputs regarding new policies, benefits, and updates.

- Push Notifications

Users can get app updates through push notifications as they effectively improve communication between users and businesses. Also, new discounts and policies can be sent regularly to application users through the mode.

- Support

Since users prefer to use the app if they need something, having a Virtual Assistant or an AI-powered chatbot available 24/7 is essential. Moreover, because FinTech projects have highly confidential information, consultants must be deployed to handle customer queries under strict safety rules and requirements. You can combine the two options and build a dependable customer support platform that can be reached in time of need.

- Financial Operations

Based on the niche and fintech app business model, the FinTech app must have core features like –

- Transfer money

- Receive and make payments

- Connect multiple bank accounts

- Wealth management

- Access and pay bills

- Personal finance features

- Check Balance

4) Choose the right development team

The best way for FinTech app development is to outsource as it not only saves time and money but you also get a team of highly experienced developers. The team size would typically depend on the technology stack you choose, the type of app and duration, the choice of platform, etc.

It is advised that before hiring a team of developers, you should check their experience in the FinTech industry, and compare the rates and the experience of developers.

The following is the technical expertise that is needed for an app development project

- Web Developers

- UI Designers

- Project Managers

- Business Analyst

- Quality Assurance Specialists

- Android/iOS Developers

- Frontend and Backend Developers

5) Design the FinTech application

FinTech apps must have a highly engaging and simple UI to render the best experience. Therefore, sketching a good UI before developing the app allows you to view the app’s overall look and feel. Ensure that you test every element right from font style and color to element color before you move on to the next phase and make changes as necessary.

6) Develop a FinTech app MVP and launch it into the market

Minimum Visible Product (MVP) can be a good decision to identify if your idea will succeed in the market or not. An MVP consists of the basic features of your app and development without extra costs, thus saving money. After the release of the MVP version, it is essential to get user feedback from the target market to study the behavior and then include advanced features in the app.

7) Quality check after launch

Things don’t stop after the launch of the app. All challenges and difficulties encountered by users must be mitigated and quickly resolved. To enable this, the following measures can be taken.

- Upgradation of the program to the most recent OS version

- Upgradation of libraries and third party services

- Verify the latest updates and do all security audits

- Flaws and defects must be corrected proactively

- Reorganize current code without altering it functionally (if needed)

No app is complete without a few challenges of its own. Now that we know how to build a FinTech App let us see some critical challenges in FinTech app development.

FinTech App Development: Challenges

FinTech app development is not easy. The development journey can be ridden with obstacles that can come in the way of developing an innovative, high-quality app. Here are some potential roadblocks that can come your way in creating a good FinTech app for your consumers.

1) Maintaining Data Privacy and High Levels of Security

What matters the most in developing FinTech apps is maintaining high-grade security with no room for errors or data breaches. Due to the involvement of users’ sensitive and private information such as id, password, CVV numbers, and debit/credit details, even a minor vulnerability can be catastrophic.

Fintech apps must provide consumers with an app that they can completely trust and is secure enough. Even a minor lapse can lead to them uninstalling the app and searching for alternatives.

Some ways to secure the app are by implementing data encryption, 2-factor authentication, real-time alerts, updating the software regularly, and testing the app periodically to detect a breach or identify vulnerable areas.

2) Complying with Stringent Government Measures

There have been companies in the past that have taken advantage of the loopholes in the government’s digital banking rules and regulations. As a result, more substantial procedures that companies must comply with are in place to safeguard customers from fraud.

Before you build a FinTech app, research the government regulations of the place or country, and adhere to all the rules. The technology stack you use, business strategy, and data you collect must be complied with, or your business can face severe consequences. Ensure that a legal team or advisor is hired to walk through the nuances so that you implement the changes quickly.

3) Providing a Seamless and Right User Experience (UX)

Ensure that your app is up-to-date with the latest UI/UX designs and make changes as per market if needed. Then, a proper competitive analysis can be done; where you can look at other apps in your niche to find unique UI/UX solutions you can implement.

Developing a seamless and proper UX for apps has become critical for success. In the case of creating a FinTech app, it is crucial to provide a positive and responsive user experience. With a prime focus on meeting financial requirements and expectations, the FinTech app must be developed well so that users understand the interface and transact easily.

4) Using the Latest Technology Stack

Staying up-to-date with the latest technological stack is a significant issue that FinTech apps face. The tech stack refers to the architecture that the apps are built on, including the front end, server, database, and OS. The best tech stack has the most technical advantages as it performs equally well on all platforms and devices.

Regardless of the number of features, the app must be secure to run on without encountering any glitches, leading to an increased customer base.

Also read: How to build a Stock Trading platform?

How much does it cost to build a FinTech app?

Fintech development app cost estimate depends on the following.

- Niche of the FinTech app

- Location of the app development company

- Hourly developer rates

- Technologies and API integrations used for the platform

- Cost of Maintenance

The following is a rough average cost for building a FinTech App

| Type of FinTech App | Price |

| Basic | $30,000 to $50,000 |

| Average | $50,000 and $80,000 |

| Complex | $80,000 + |

The following is an average estimate of the different types of FinTech Apps.

| Type of App | Costs |

| Banking App | $40,000-$70,000 |

| Lending App | $30,000 to $50,000 |

| Insurance App | $45,000 and $70,000 |

| Investment App | $60,000 and $120,000 |

| Consumer Finance App | $50,000 to $300,000 |

Another important aspect that can influence the price of FinTech development is the location of the development company. The following are the average hourly prices of developers in different regions.

| Country | Rate per hour |

| US | $100-$120 |

| UK | $60-$100 |

| Ukraine | $40-$100 |

| India | $30-$80 |

By putting together the multiple factors listed above, the average cost to develop a FinTech app can vary from $30,000 to $300,000 in a timeline of 4 to 8 months.

Finally, let us now look at how FinTech apps make money

How do FinTech apps make money?

FinTech apps have gotten a lot of attention in recent years, and in this section, we will see how FinTech apps make money.

1. P2P Lending

Peer-to-Peer lending(P2P) enables individuals to obtain loans directly from other people without the need for financial institutions or intermediaries. With this model, people can earn interest on the money lent, and FinTech app can earn commissions on each transaction. Thus, by creating such platforms, lenders can be matched to borrowers, and a fee can be charged during the repayment process.

The global peer-to-peer lending market is expected to surpass $44 billion by 2024 at a CAGR of 19%, as per Report Linker reports.

The FinTech business model is gaining momentum around the globe, with the US being the No.1 P2P lending market. Some notable examples include Upstart, Prosper, and Peerform.

2. Subscription-based

Businesses can allow users to use their apps where the billing occurs monthly, quarterly, or yearly. They can also have a Freemium payment model where users can access the app for free but have to pay a fee to access premium features.

This is one of the safest ways to generate income from online users without any third-party integrations in the app. Some examples of subscription apps include Robinhood, Revolut, Mint, MoneyLion, etc.

3. Advertising

Apps have become a source of digital advertising where they monetize ads and make money. For example, as a business owner, you can display commercials inside your app and get paid from third-party ad networks.

You can get paid each time an ad is clicked on your app. You can partner with finance, trading, and banking firms to advertise on your app through banner ads such as audio, video, images, etc that can be displayed anywhere without user experience getting compromised.

4. Digital Wallets

The global digital payment market is estimated to reach USD 180.2 billion by 2026, at a CAGR of 15.4%, as per Markets and Markets.

A digital wallet combines a simple bank account and a payment gateway. It allows users to preload virtual money into their e-wallet and use it to pay for goods or services. These digital wallet apps can also make money by selling consumers third-party financial services.

Customers can benefit from contactless payment for a small fee that is changed to business in the form of a Merchant Discount Rate by FinTech companies. Examples include Square Cash, Venmo, and typical end-user wallets.

5. Robo-Advisors

They are platforms for generating income from trading without paying investment advisors. Your FinTech app can use cutting-edge technologies such as AI and ML that act as Robo Advisors and manage portfolios effectively. As a result, they charge a lower commission than a portfolio management firm, saving investors a lot of money.

Investors can find it more cost-effective as apps only change a certain percentage of their total assets. Some well-known examples include Robinhood, Wealthfront, etc.

6. Payment Processors

These platforms allow customers to pay online and are called payment gateways. They act as intermediaries who handle the data provided by customers during checkout. They receive the payment information and secure and encrypt it before sending it to the particular payment processor.

The platform handles the sales request and informs the customer’s bank to verify sufficient funds. Then, the app gets a response from the bank for the acceptance or denial of the purchase. Processors can also deal with authorization and payment completion. Some successful FinTech companies in this segment are Stripe, Adyen, WorldPay, etc.

Also know – A Fail-proof Mobile App Launching Strategy

Summing Up

We hope this guide helped you understand a FinTech App, its types, costs, and how to build one.

There’s no doubt that FinTech is gaining popularity, especially since they are user-friendly, low maintenance, and offers state-of-the-art security. The time is right to seize the moment to build a robust solution.

You may encounter various challenges before developing a FinTech app, and choosing the right technical expertise can easily overcome these issues.

The right FinTech mobile app development company can help you explore innovative strategies to transform existing operations and match changing market trends. From building eWallets to data management solutions, Ailoitte can help you make the best use of current technologies and bring your ideas to life.

We have helped many organizations explore innovative strategies, improve workflow, cut costs, build apps, and streamline operations. We recently worked on developing a stock trading mobile application, QuanTrade, for Android and iOS, with a rich user experience and robust features allowing users to trade in desired markets. We provided the highest levels of user security and many value-added features, which resulted in a 36% increase in new users.

So, what are you waiting for? Contact us if you want a feature-packed FinTech mobile app compatible with iOS and Android, and know which features align best with your goals and challenges.

FAQs

“Fintech” is a combination of the terms “finance” and “technology”. It refers to software, or an app businesses use to provide automated and improved financial services.

Examples of FinTech applications include banking apps, payment apps, peer-to-peer (P2P) lending apps, investment apps, trading, and crypto apps, among others like MoneyLion, Robinhood, Nubank, Coinbase, Chime, etc.

The four main types of FinTech apps are insurance apps, investment mobile apps, digital payments, and money lending applications.

FinTech apps make money through crowdfunding, lending, robo-advising, data transmission, fees and subscriptions, budgeting, and financial management.

The average cost of developing a FinTech app varies from $30,000 to $300,000. However, the exact figure depends on a broad range of factors discussed above in the article.

.png)

.png)

.png)

Leave a Comment