Fintech Apps development trends are rapidly transforming into increasingly lucrative ones for large and small businesses alike. Essentially, the need for digital transformation worldwide has accelerated the growth of fintech solutions provided and the need for solutions that are yet to come. The latest fintech app development trends have emerged due to such increasing growth in the sector.

They are an indicator that the financial technology (FinTech) market will likely witness more financial/business growth in the coming years. For example, digital payments (the largest segment of Fintech) value reached $8,488 billion in 2022, and an estimation indicates that its global user base could reach 5,480 million by 2027.

With such growth, the app development industry will have to keep up by incorporating new technology and fintech’s latest trend into their development approach. The right approach for this would be to find fintech ideas and technologies that increase the user experience of consumers. For example, it is much easier to apply for a loan with a few clicks on a P2P loan app and get it approved within minutes than visiting a bank in person and filling out all the documents.

There are many emerging fintech app development trends that a business owner or an aspiring one, such as yourself, must be familiar with to add a competitive advantage to your app.

Read: How to build a Fintech App for your Business/startup

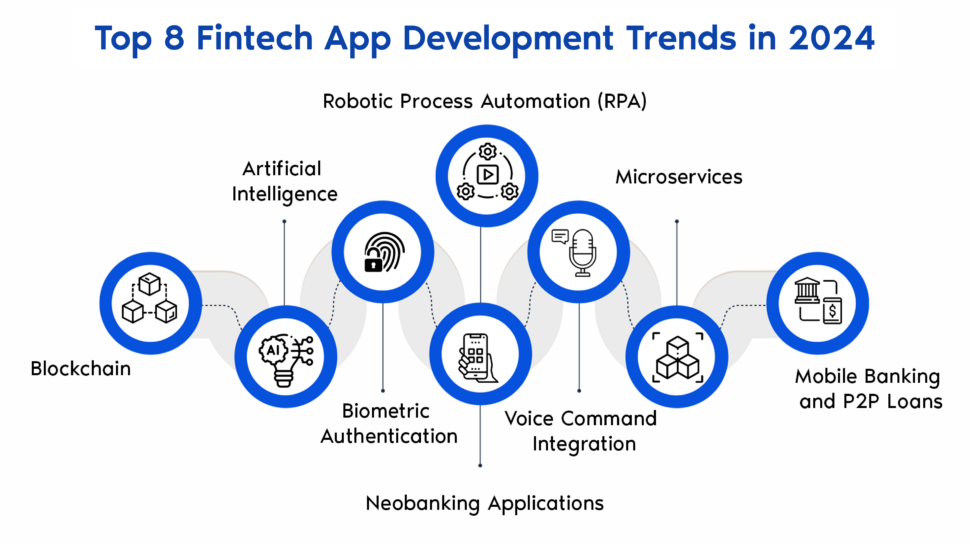

Top 8 Fintech App Development Trends in 2024

As new digital technologies come into play, you can expect more and more fintech app development trends to appear.

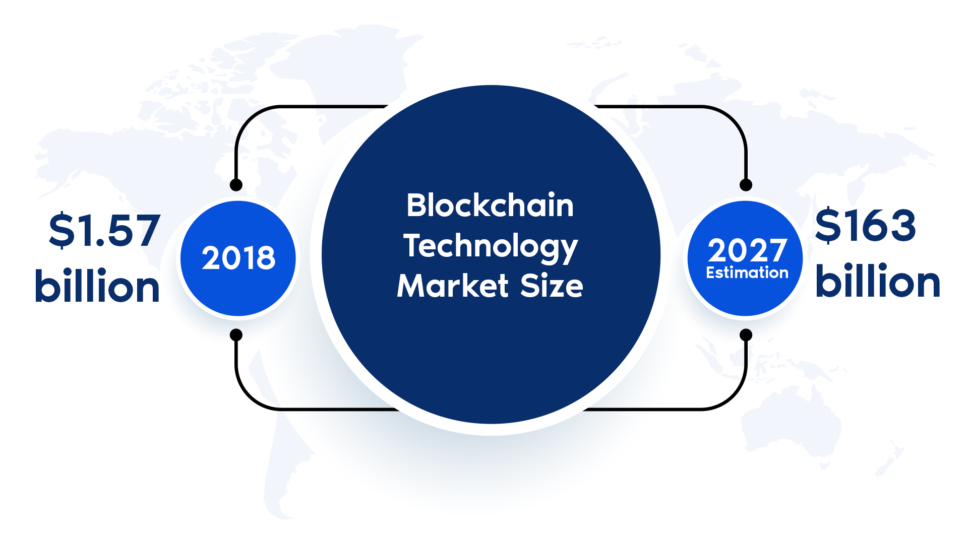

Blockchain

Blockchain technology is a decentralized, secure, and error-free network that enables superior digital finance for all users. By incorporating blockchain into your app development process, you can increase the security of your fintech app, accelerate payments, and provide cost-effective transactions.

Source: Statista

The current digital finance networks have a reputation for not being entirely secure for users and often lead to data leaks, expensive transactions, and financial scams. Blockchain removes such possibilities by eliminating the need for third parties (such as banks) in finance-related activities such as transactions.

You can add Smart contracts, secure payment gateways, and provide better financial management and security by incorporating blockchain in the development process. A fintech app that supports blockchain payments and finance management will stand out among the list of fintech apps available in the market.

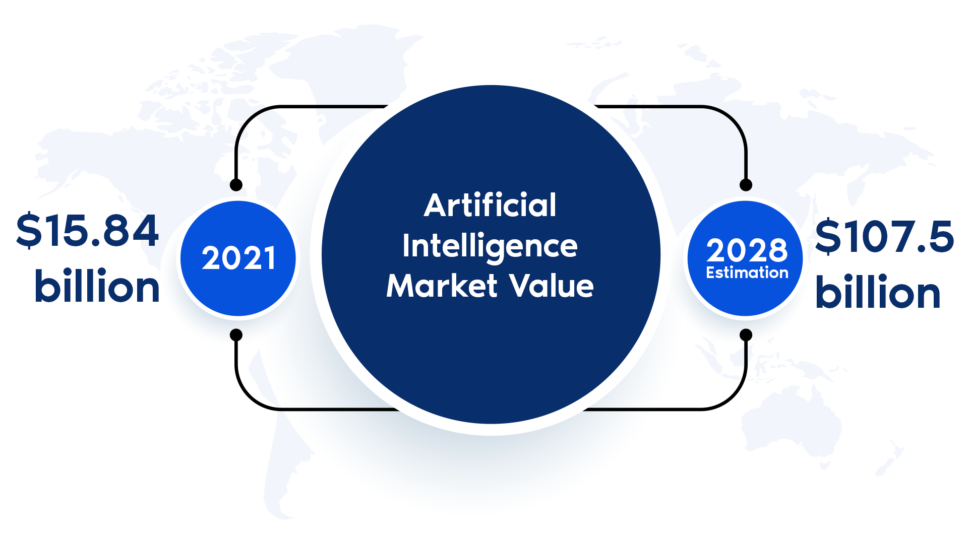

Artificial Intelligence

Multiple mobile banking applications offer AI-based financial service support to users to increase the accuracy of the information and accelerate the process. Similarly, many P2P loan apps use AI-powered evaluation systems to determine which users are eligible for what loan and which are not. It allows them to prevent risks more accurately and create personalized loan offers. Artificial intelligence leads to better personalization in a fintech app, making its processes more user-friendly.

Source: Statista

Including AI technology in your fintech application development leads to reduced cost and saved time, automated conversational support, marketing research and predictions, fraud detection, and improved security and user experience.

Fintech businesses can create complex financial market models based on real-time data powered by AI to provide personalized solutions to clients. Ultimately, Artificial intelligence helps make better financial decisions and reduces customer service costs.

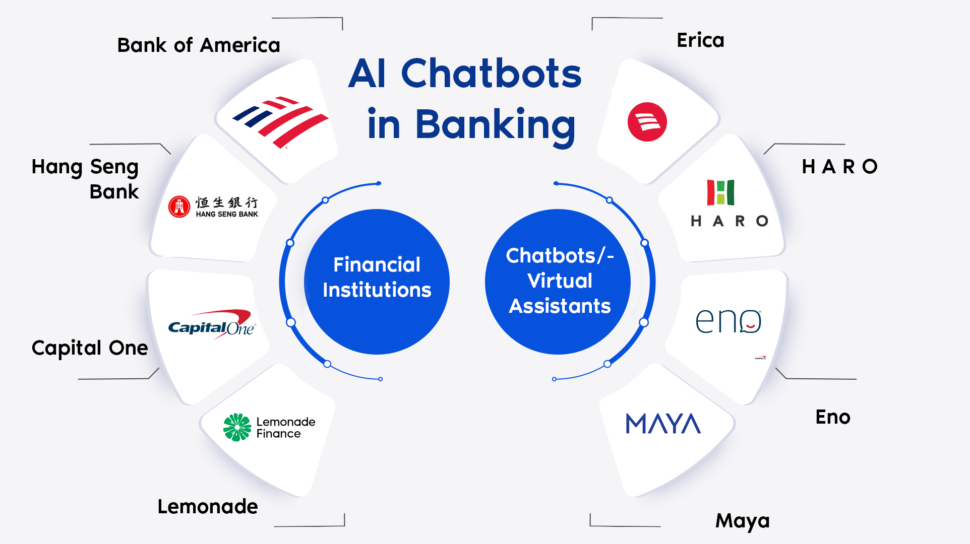

AI Chatbot Banking

AI-powered chatbots are one of the innovative inventions to provide to users through your fintech application. It significantly reduces workload, increases productivity, improves user experience, and helps provide 24/7 customer support.

Almost every fintech app in the market now has AI chatbots. The problem is that only some of them are actually user-friendly and provide value. Something you must keep in mind when incorporating this technology into your fintech app.

Sources: Bank of America, Hang Seng Bank, Capital One, Lemonade.

Additionally, AI chatbots help solve minor consumer issues, get user feedback, and guide new users in seconds. They are an innovative addition to any fintech mobile application, designed to give it a unique competitive edge.

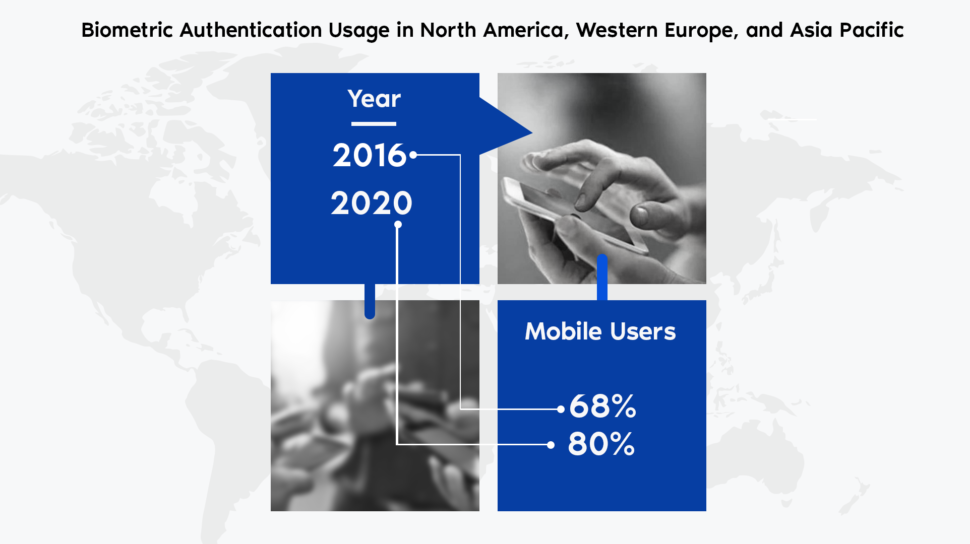

Biometric Authentication

Biometric authentication is already a highly incorporated trend in the fintech mobile app development industry. It has proved its value by increasing the security and privacy of every user by making unauthorized access nearly impossible. Financial data becomes more secure in mobile apps due to this technology.

Although you cannot always rely on the accuracy of voice, face, and fingerprint recognition, biometric authentication is one of the best technologies you can add to your fintech mobile application. It can protect users and the financial data of your company from many hackers that are good at guessing passwords/pins.

Source: Statista

In short, implementing biometric authentication with face, voice, and fingerprint recognition leads to better user verification, fraud prevention, and data theft or leaks. Such identification also improves user experience by removing the need to type in passwords to log in on the fintech app. Along with biometric authentication, Multi-factor Authentication is also helpful in preventing unauthorized access and improving the security of transactions.

Innovative technology like biometric and multi-factor authentication can increase the security and privacy of your fintech application, a trait valued and expected by the users of such applications.

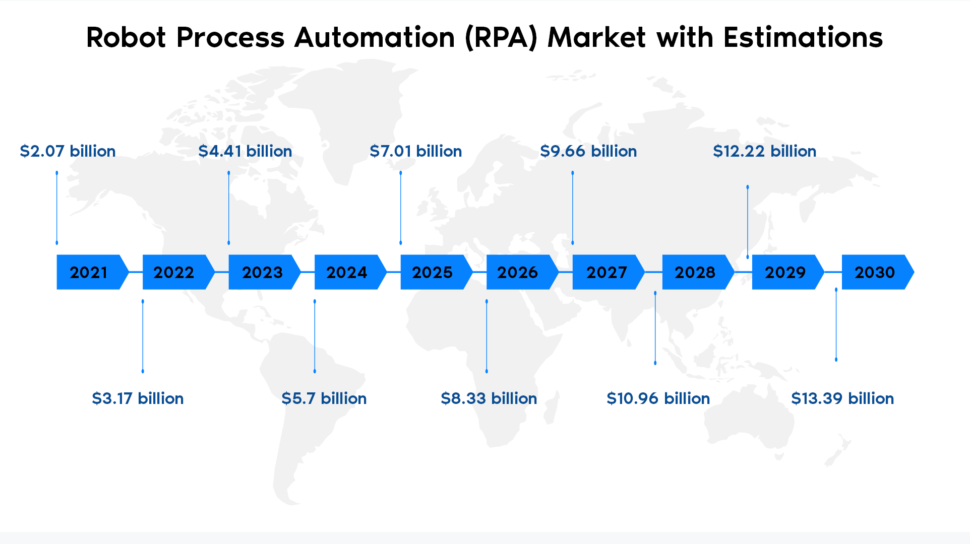

Robotic Process Automation (RPA)

Unlike Artificial intelligence, Robotic Process Automation uses available and verified data, inputs, and logic powered by current and historical data to increase the efficiency of financial reporting, risk assessment, and financial statement auditing. Its automated solutions can significantly accelerate multiple processes in your fintech app.

Robotic process automation can interact with many systems in your fintech app to further increase the accuracy of its solutions and prevent risks that can lead to financially disadvantageous outcomes.

Source: Statista

RPA in fintech apps is a crucial trend that can help personalize the experience of solutions a financial institution can provide to their customers. With the right tools, financial institutions can build and deploy Smart and automated algorithms/bots that interact with the application interface to enable improved decision-making with better accuracy.

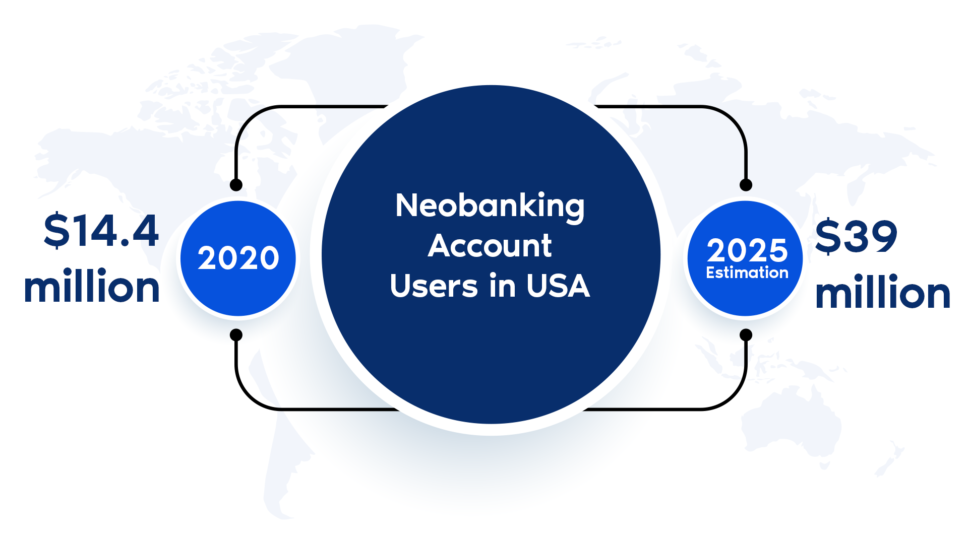

Neobanking Applications

Neo-banking apps are digital banking platforms present and existing only digitally to provide banking solutions through the same. They offer an instant platform for making payments, large money transfers, loans, and lending. Some examples of neo-banking apps are Albert, Moneylion, Aspiration, Chime, Current, Varo, and Dave.

Unlike traditional banking, neo-banks ensure a faster digital experience in finance and regular transactions. Whether it is an established financial institution or a startup looking to enter the fintech industry, neo-banking apps are a quick way to ensure the business grows since such apps attract target users much faster than others.

Microservices

Microservices focuses on an architectural element of the technology when building applications. They are composed of small services owned by short teams that can interact over APIs. The technology can simplify fintech application development, accelerate deployment, and increase the efficiency and flexibility of financial institutions through the application.

Source: TechRepublic

They allow financial services provided through fintech apps to be more efficient and responsive to change, ensuring top-tier solutions and a user-friendly experience for all consumers. Microservices are one of the best trends to incorporate in your fintech application and ensure you have a platform that stays up-to-date with the latest technology and the ever-changing needs of consumers.

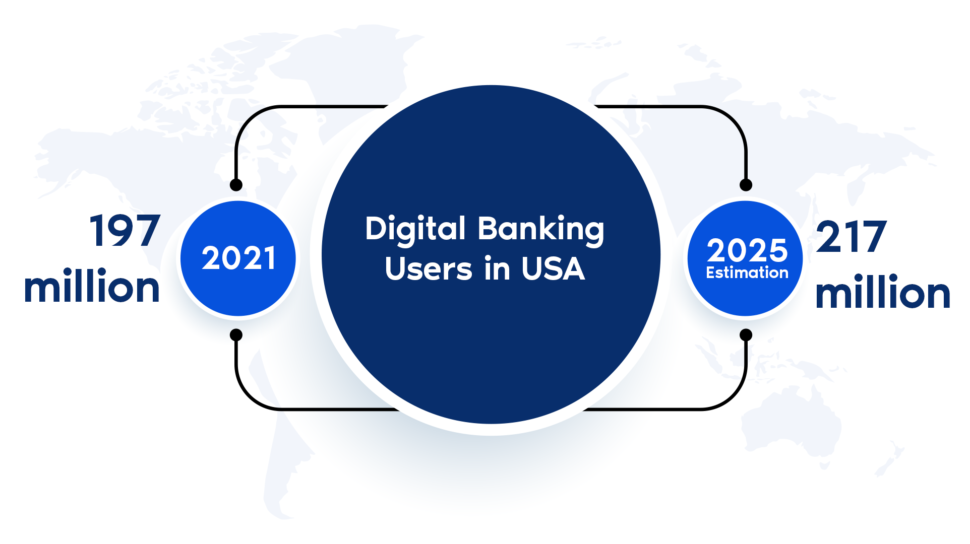

Mobile Banking and P2P Loans

Mobile banking and P2P loan lending are unavoidable and highly lucrative elements in any fintech mobile application today.

A fintech application not providing solutions that accelerate the time-consuming process of credit card applications, money deposits and transfers, stock trading, and loans lack an element that would attract most target users toward your app.

Source: Statista

It is because users are now exhausted from the overly time-consuming process of credit card and loan applications, money transfers, and investments. Any app that can make such a process a task of a few clicks (with AI-powered and automated technology) has a better chance of getting a large user base, loyal customers, and increasing business revenue.

Voice Command Integration

Virtual assistants like Siri and Alexa are functionalities preferred by millions of smartphone users to access various fintech app features on their mobile devices.

They prevent physical effort by users and provide a conversational experience in smartphone usage. Creating a fintech mobile application that can respond to the commands received by virtual assistants further improves the overall user experience of your app.

Although it comes with increased app development costs and hours, integrating your fintech application with the technology required for compatibility with various virtual assistants is a worthwhile inclusion that will ensure lasting benefits for your business.

Conclusion

Taking your fintech application to the pinnacle of the fintech industry would require you to incorporate as many of the mentioned fintech trends as you can into your app development process. They are the backbone of every highly advanced interface and a convenient user experience, two qualities every mobile application needs in order to provide real value to target users.

You can analyze your budget and business requirements to see which fintech industry trends fit into your mobile application and get the most skilled developers to do the job. Remember, skill and experience will be required to ensure you implement technology-driven trends into your fintech application without any flaws or errors.

You may end up with faulty technology inside your fintech application without suitable developers. For example, poorly developed AI chatbots and biometric authentication can ruin the user experience of your fintech app.

That is why getting the right fintech app development services is essential to get the best of all the fintech app development trends can offer for your app and grow your business with a technology-driven approach.

Frequently Asked Questions

The fintech app development costs range from $35,000 to $66,000 for a standard version, $20,000 to $25,000 for an MVP version, and $80,000 to $150,000 for an advanced fintech application.

However, the final development cost varies according to your business and application requirements, UI/UX design approach, and app developers.

The average time to build a fintech application would be around 6 to 8 months to 1 or 2 years. Again, the cost and duration entirely depend on your project/business requirements, development approach (Agile or Waterfall), and developers.

Python, Java, and Swift are the best programming languages for building a fintech mobile application. Be that as it may, discuss this with your developers and fintech industry experts to choose the best programming languages for your fintech app.

India is currently the best country to hire Fintech app developers as they provide innovative software solutions at affordable/reasonable costs. The country houses experts driven by the need to provide better security and privacy to the multiple solutions of the financial industry. It is a quality that can benefit any fintech app development project.

Insurance, stock trading, finance, digital payments, and money lending are some of the top fintech industry categories.

.png)

.png)

.png)

Leave a Comment